Wow, what a month! We will only know in hindsight, but Russia’s invasion of Ukraine and the resulting financial response from the west could be pivotal in the evolution of the global monetary system. As people try to make heads or tails of the destruction in the Ukraine potentially seismic shifts are underway financially. The events have displayed specific use-cases for bitcoin and the long-term outlook for censorship resistant borderless money is as strong as ever. Despite the increasingly positive long-term outlook, sanctions, the commodity supply constraints and tightening traditional financial market liquidity place short-term pressure on risk appetite and bitcoin as a result. TLDR: Bitcoin fundamentals remain strong but trad-fi macro presents challenges in 2022 and patience is still required until the Fed blinks and re-liquefies markets.

Conclusions:

- War in Ukraine and sanctions on Russia provide further evidence of bitcoin use-cases.

- Global Reserve Currency System undermined by sanctions.

- Prepare for a potential PR backlash if Russian oligarchs evaded sanctions through crypto.

- Sanctions, commodity price increases and credit market tightening presents liquidity risks and downside price potential but also raises the prospect of further Fed balance sheet expansion in response to potential global recession.

- Bitcoin fundamentals are strong, long-term holders firm. Institutional demand confirmed but broad-based demand still weak.

- Gold recovers but underperforming BTC. High-beta not favoured.

- Cyclical conditions advise patience in 2022.

I will avoid going into detail on Russia-Ukraine as I am sure you have heard enough about it from other sources. Clearly its important to assess the impact on crypto markets though. Last month I wrote about potential BTC demand from ‘Rogue States’ like Russia. Who knows if the Russian central bank is actually purchasing bitcoin (probably not), but Russia and Ukrainian citizens alike saw the power of censorship resistant money during February.

- Bitcoin provided protection for Russian holders who saw the value of the RUB fall 37% during Feb on account of their tyrannical and reckless leader.

Bitcoin spiked on the last day of Feb after Putin restricted Russian’s from accessing foreign currency. Russians appear to be flocking to bitcoin due to imminent need to get capital out of Russian RUB. The spread between the Russian bitcoin price and the rest of the globe is reported to be around 20% in peer to peer markets at the moment.

It is possible that Russian oligarchs were involved in the BTC demand. If indeed this speculation turns out to be true, watch out for any Public Relations (PR) backlash. As I said last month, “Bitcoin’s detractors (of which there are many) will likely use rogue state adoption as a stick to beat bitcoin with, calling it un-American and anti-West. Holders will face a real test under this weighty narrative and we must prepare in advance.” Western media will see oligarchs in the same light as rogue states.

Global Reserve Currency System Undermined

As part of the tighter sanctions, western governments have restricted the Russian central bank from selling its foreign currency reserves dominated in western currencies. This is an incredible event, and it is worth dwelling on for a moment.

Countries spend years accumulating foreign currency reserves through importing less than they export. They safeguard these savings in the assets at the centre of the global currency system, US Treasuries. Moreover, central banks place Treasuries at the centre of their own financial systems, as the reserves for their domestic currencies.

Yet, the US government has just announced that Russia cannot use their reserves when they want to…? Russia has effectively been censored from its own savings pool.

I know the Russia-Ukraine conflict is in an extreme situation and the censorship and freezing of assets might be justified, but (from what I can tell) this type of asset restriction of global reserve assets is unprecedented. One could easily argue that the west has declared economic war on Russia and its citizens, including seizing the assets of Russian oligarchs.

There is a reason why freezing global reserve assets is unprecedented. It effectively calls into the question the reserve currency system.

Before you think that I am jumping to unsubstantiated conclusions, what do you think the other countries make of this situation? What about China? It is common knowledge that China wants to invade Taiwan in the coming years. China now must seriously consider a potential restriction on its ability to sell its own reserve assets under an invasion scenario. That is a potential game-changer! China has already stopped purchasing US Treasuries over recent years, but what if it becomes a seller?

For a long time, I argued that China cannot recklessly sell its Treasury reserves because this would harm its own investment position. But if asset freezing and seizure is a bigger risk to consider, perhaps sales become a more realistic proposition?

The Wall Street Journal picked up on the changing role of the US dollar last week (headline above). In other words, people are starting the global reserve currency system. Can Treasuries really be considered a store of value when the asset is someone else’s liability? You cannot store and secure Treasuries within your national borders, so how secure are they during a time of economic and political conflict? Not only are you reliant on the US government maintaining inflation stability and creditworthiness, but you rely on them fulfilling their obligation. There are many countries in the world that are not particularly friendly with the US government and might not like to consider the credibility of this obligation.

During times like these where countries are less economically, politically, and strategically aligned, those promises are more questionable. Assets without counterparty risk may fetch premium, like gold, bitcoin, and commodities. When you hold or custody assets which have no counterparty risk, it is far more difficult to seize or freeze them.

Whether or not Russia has bitcoin or has ever considered buying it, the case for a censorship resistant global monetary network grows ever stronger.

Usually wars = buy-the-dip but is “this time different”?

Risk appetite came under pressure in the lead up to the war and the announcement thereof. It was no surprise to see a recovery in risk appetite after the initiation of conflict. Historically markets have tended to sell-the-rumour, buy-the-fact with regard to war.

Additionally, there are several complicating factors to this conflict:

- It does not look like Russia will steam roll Ukraine into a quick end to the conflict,

- Putin is threatening nuclear weapons,

- widespread support from Ukraine in the western media has led to tighter sanctions,

- sanctions are leading to cascading impacts on global markets, and

- this market shock is taking place at a time when global market liquidity was already tightening

Global recession and credit crunch risks are rising quickly

Initially the sanctions imposed on Russia were pitiful, but they intensified over the past week to such a degree that Russian banks were excluded from SWIFT. The SWIFT restrictions pose potential credit risks for the global banking sector as many global banks are intertwined with Russian banks. A portion of this risk is reflected in rising banking credit default swaps (insurance contracts on bank defaults).

Interbank stress is also observable elsewhere in the market. The contagion risk from Russian banks is certainly not the only concern though. Numerous commodity prices have sky-rocketed on the back of the expected supply shock. Oil is the one grabbing headlines, but wheat futures are also exploding because Ukraine and Russian account for almost 30% of global wheat exports.

Oil prices have risen by more than 50% over the past year. These types of sharp commodity price increases don’t guarantee a recession, but they raise the risk thereof.

A recession would not be entirely the fault of the geopolitics, war and sanctions. The US yield curve flattened sharply in 2021, highlighting that economic troubles were on the horizon. The Russia-Ukraine-Sanctions situation just brought these risks forward.

Bond markets have had a hard time pricing these shifts. On the one hand, bonds are faced with the highest inflation in 30 years, which should pressure yields higher. But bonds are also trying to price major geopolitical risk, which usually results in strong demand for the safety of US Treasuries. The result of these conflicting signals is major bond market volatility. The Merrill Lynch bond market volatility index has reached its highest levels since March 2020, which signals the magnitude of the conditions in which we find ourselves.

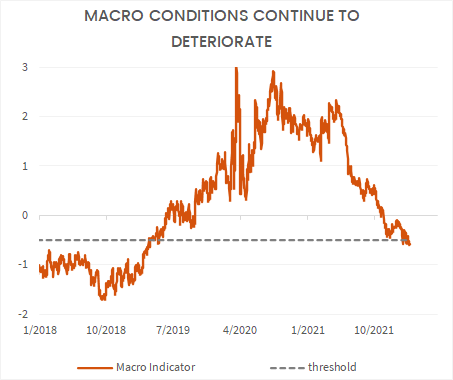

Fed hikes pared back but macro conditions trending tighter, for now

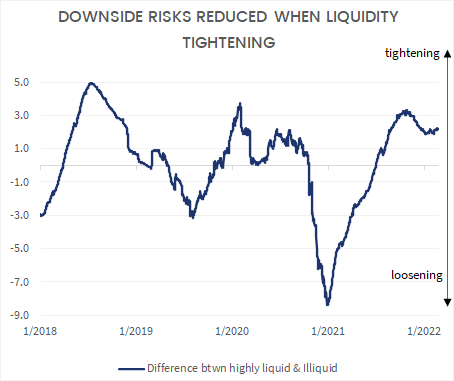

Illiquidity in traditional financial markets poses a threat to risk assets, including bitcoin. Sudden bouts of illiquidity can cause sharp drops in asset prices. For example, bitcoin fell 56% in 2 weeks during the March 2020 covid crash, falling from $8.5K to $3.8K. That being said, when we see illiquidity, bond market volatility and recession fears investors quickly turn our heads towards the Fed to ask “what is Jerome Powell going to do?”

The Ukrainian conflict has already impacted rates markets. Participants only expect the Fed to hike interest rates once in March, after previously expecting 50bps worth of hikes. But if recession risks are rising, the question becomes will the Fed hike more than once?

The Fed is obviously concerned about inflation, as it should be, which is why the market is still pricing rate hikes. But a further deterioration in liquidity and markets could force the Fed towards aggressive stimulus measures to restore financial stability. Remember, financial stability is part of the Fed’s mandate and there is no way that Fed officials want to oversee a collapse of the financial system, which is the type of risk that exists if market liquidity deteriorates quickly. With interest rates already at zero, what have they got in store? The Federal Reserve could be set to make the 2008 and 2020 balance sheet expansions look like child’s play.

This scenario makes a compelling argument for bitcoin and is another reason why I am wary to reduce exposure dramatically. The potential upside, once the Fed blinks, is asymmetric. For example, bitcoin took just 6 weeks to recover the losses post the covid crash and it went on to rally from $8.5K to $29K between May 2020 and Dec 2020 (a 240% rally). The 14.5% bitcoin rally on the last day of Feb provides additional insight into the speed at which bitcoin can move. My bias tells me that we need to see a more noticeable shift in Fed policy and our macro indicator before these types of trading days become regular appearances.

Bitcoin fundamentals remain strong but broad-based demand weak

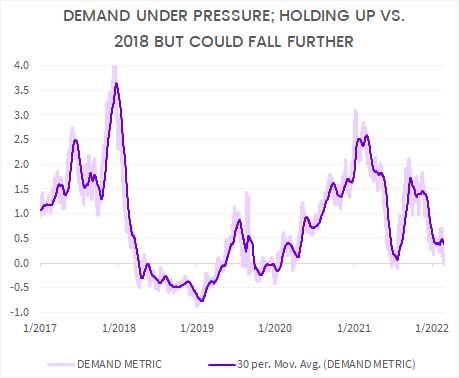

Bitcoin internals have remained strong despite the sharp correction in Dec and Jan. Coins have moved to strong hands and long-term holders have not been selling on masse. Our medium term liquidity metric has remained very resolute. This can create a supply squeeze and push prices higher, which definitely contributed towards the sharp rally at the end of Feb.

Last month I spoke about institutional demand for BTC below $40K. We have now received news that Morgan Stanley has been adding exposure to its asset management portfolios.

Despite the anecdotal evidence of institutions buying bitcoin and the constructive behaviour of long-term holders, broad based demand is still pretty weak relative to levels seen through the 2020 and 2021 bull market. Demand is stronger than the 2018 bear market, which is encouraging. But given the tough global macro conditions, I cannot rule out the possibility that demand ratchets another leg lower though 2022.

Gold having its time in the sun, but underperforming BTC

After falling 18.6% in Jan 2022 and falling 16.7% in Dec 2021, BTC rallied 14.3% in February 2022. It was a choppy month with BTC rallying from $38K to $45K before falling all the way down to $34K on the Russian invasion of Ukraine. BTC closed the month strong to $43.2K at the end of the month. Gold rallied 6.1% on the back of the Russia-Ukraine news, which catches my eye.

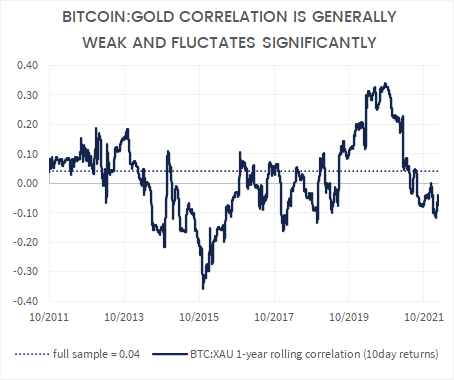

I think bitcoin is superior to gold technologically, but I continue to think gold still has a place in balanced portfolios. This argument is strengthened by the weak correlation between bitcoin and gold. I.E. The bitcoin-gold correlation is not consistent, so the assets provide differentiated sources of return within a portfolio.

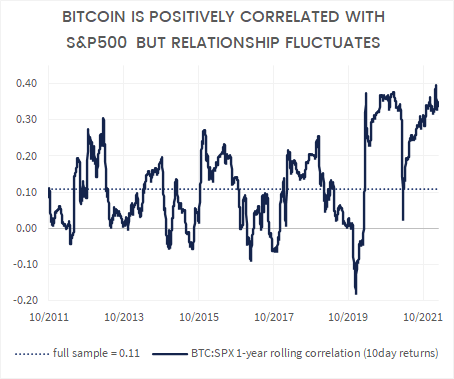

Bitcoin does not currently act as a safe-haven asset in portfolios like gold or US Treasuries, which can rally during times of market distress. Why? Bitcoin outsized return potential implies that it trades more like a risk asset than a safe haven. I.E. Bitcoin has a stronger correlation with the S&P500, than gold.

The correlation to the S&P500 does not imply that bitcoin does not protect investors against numerous risks, nor is bitcoin just a high beta tech stock. Feb was case in point: bitcoin rallied on the last day of Feb because investors needed a borderless, censorship resistant monetary technology. The S&P500 lagged.

Despite the strong performance of gold and its continued relevance in portfolios, it is noticeable that during one of the strongest months for gold in recent history, bitcoin outperformed gold. Obviously, gold has outperformed bitcoin over the past quarter and year (26.5% q/q and 18.4% y/y respectively) because bitcoin has fallen. But bitcoin held its own due to Feb volatility which is quite something. Bitcoin also outperformed the S&P500 by 18% after the S&P500 fell 3.1%.

It would be silly to make a strong conclusion from one months’ worth of data. As I have said, gold continue to have a place in portfolios and it could have an important role to play in geopolitics over the coming years because it is an asset that the establishment is far more comfortable with than bitcoin. But bitcoin poses serious competition to gold and the S&P500 as a store of value. Those who do not see this are missing the woods for the trees

Not a good time for high-beta

After falling 25.8% in Jan 2022 and falling 17.8% in Dec 2021, ETH rallied 6.3% in February 2022. By comparison, bitcoin rallied 14.3% in Feb after falling 18.6% in Jan and falling 16.7% in Dec 2021. ETH underperformance vs. BTC highlights our 2022 thesis that this is not the condition for high-beta.

It will be difficult for most of crypto to outperform bitcoin under these conditions.

I still expect pain to emerge in the NFT market, which may be a signal of final capitulation. We have not seen anything of the sort yet.

More froth may still need to come out of the crypto markets this year

Bitcoin marches on but patience is required in 2022

I know I sound like a broken record player on bitcoin sometimes because everything is a potential bitcoin catalyst to me. But that is just the reality of the world that we live in. The monetary system is archaic, it is decaying in front of our eyes and bitcoin is a potential solution so use-cases for bitcoin are everywhere! Who would have thought that a war between Russia and Ukraine could be such an important use-case for bitcoin.

I have steered away from economic, political or humanitarian comments re Ukraine so let me just clarify quickly: war is tragic, devastating and my heart goes out to all of those in Ukraine and Russia that are effected by this unnecessary conflict. Whatever your opinion on that matter, Russians and Ukrainian’s need bitcoin more than ever and the evidence for this view is clear in Feb 2022.

Pulling back the lens from Ukraine, macro conditions remain tough so while the short-term outlook for bitcoin is strong, I still think that further headwinds cannot be ruled out this year. We are not seeing broad-based demand in terms of new users and on-chain transactions. Plenty selling pressure could emerge in the high $40Ks. ETH could experience a nice relief rally in response to BTC, but I do not think this is the time for a multi-month high-beta rally yet.

I would get substantially more constructive on BTC if the correlation broke down vs. the S&P500 and or the Fed changed its tune on monetary policy. Both will likely take place this year, but patience is required.

See you in April!

Conclusions

- War in Ukraine and sanctions on Russia provide further evidence of bitcoin use-cases.

- Global Reserve Currency System undermined by sanctions.

- Prepare for a potential PR backlash if Russian oligarchs evaded sanctions through crypto.

- Sanctions, commodity price increases and credit market tightening presents liquidity risks and downside price potential but also raises the prospect of further Fed balance sheet expansion in response to potential global recession.

- Bitcoin fundamentals are strong, long-term holders firm. Institutional demand confirmed but broad-based demand still weak.

- Gold recovers but underperforming BTC. High-beta not favoured.

- Cyclical conditions advise patience in 2022.

This post was edited on 7 March 2022