I wrote in 2019 that “central banks have eroded store of value characteristics from traditional financial markets. First cash, then bonds, leaving investors to use property and equity as quasi store of value instruments. Negative interest rates raise the attractiveness of the age-old store of value, gold, and the store of value for the digital age, bitcoin.”

That article laid the conceptual groundwork for gold and bitcoin. In this piece I’ll share the bullish/positive case for gold investment/allocation. The recent gold gains and the equity decline could make equity seem relatively attractive, but I think we’ve entered the early stages of a new gold bull-market. This is not financial advice - individuals need to align their investments with personal preferences and long-term goals through professionals for them to be effective. I’m merely raising a few important questions for friends and family to consider when assessing the health of their long-term capital.

Non-traditional valuation required

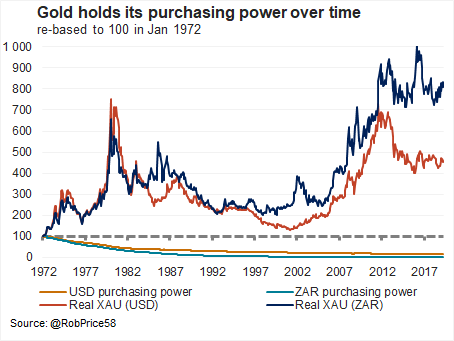

Traditional investors, often with accounting backgrounds, and mainstream economists, dislike gold because it cannot be valued through the same neat methodologies as equities and bonds. Gold has no yield, dividends, earnings or interest rate. It has limited consumption in production. It merely serves as a store of value - maintains purchasing power over time because it is scarce, durable and expensive to mine (historical evidence of out performance vs. CPI below, more detail in previous piece). Some economists value gold by looking at supply and demand metrics but this misses the point because gold demand doesn’t have strong linkages to real economic activity. Marginal demand from central banks and investors is related to gold”s store of value characteristics relative to alternative investment opportunities and the prevailing global monetary conditions. To value gold I consider two aspects: (1) relative value, (2) macroeconomic conditions.

-

Significant relative value

If other asset classes (equities, bonds, property) are cheap or attractive, then the opportunity cost of holding gold is high. Why hold gold when there are better returns available elsewhere? But traditional asset classes are expensive now! Even with the recent global equity correction, long-term returns aren’t great.

I estimate global equity will provide between 3% and 4% real returns over the next 5 years (above), which is far cry from the 7.5% real annualised returns on the MSCI World over the past 10 years. For South African investors, the All Share Index’s (ALSI) real rand return potential is closer to 3%, due to the weak domestic growth outlook. Developed Market bond yields trade at record lows and property prices aren’t cheap. The average yield on G7 10-year bond yields fell to 0.2% at the end of Feb 2020 (below), which implies extremely low long-term nominal returns. To be clear, I’m not saying that there are pockets of strong return potential in each of the underlying asset classes. Bonds could rally further in the short term…And there is potential for active managers within equity markets over the coming years… But the asset class isn’t as cheap as it could be, lowering the opportunity cost of holding gold.

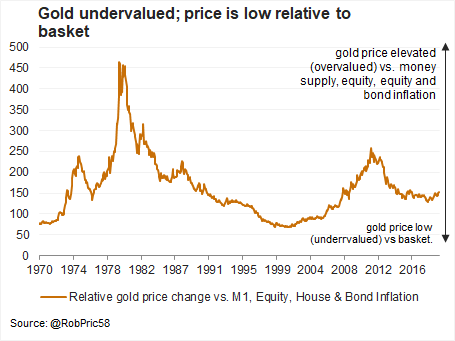

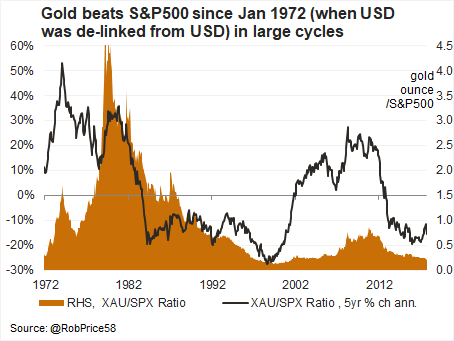

I summarise relative value by assessing the relative price change between a basket of prices (equity, property, bonds and money supply- I include money supply to account for central bank monetary inflation – below). It captures the extent of relative price movements over a lengthy period. This chart shows a clear relative undervaluation for gold.

In the past, when this ratio is below 0.1, gold’s average subsequent 1-year returns were 11% and the average 5-year annualised returns were 10%. These aren’t forecasts but provide an indication that the valuation measure has a reasonable relationship with subsequent returns over both the shorter and medium term. Moreover, we’re a long way away from the previous sell signals, which creates a “margin of safety” and a degree of confidence that we’ll witness stretched gold valuations ahead of time. When the ratio is above 1 standard deviation, the average subsequent 1-year returns are 4% and the average 5-year annualised returns are -1%, so this is a level we’ll watch out for.

-

US Real Rates are favourable

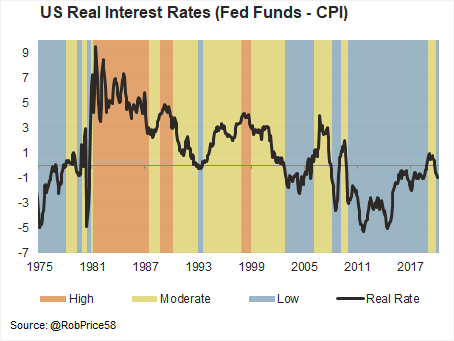

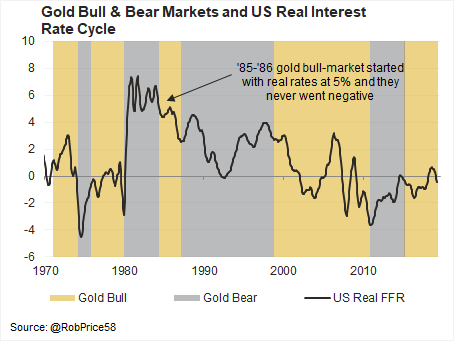

US Real interest rates (Federal Reserve interest rate less CPI inflation, graph below) is one of the most NB macroeconomic variables. As the key valuation measure for the world’s global reserve currency, it is particularly important for gold. I segment historical US real interest rates into three regimes.

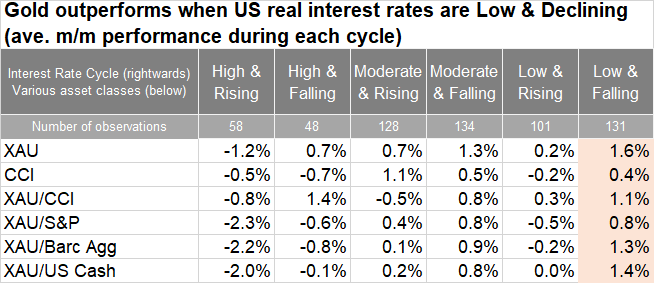

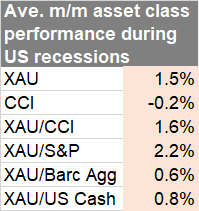

The low real interest rate regime is positive for gold returns (table below). If you’d like to understand real interest rates, why they’re a bad idea but good for gold, please read my previous piece. Falling real interest rates, when they’re already low, is particularly bullish, which is the current regime. US real rates are falling like a stone! And will likely fall further! Historically, gold has substantially outperformed other commodities (CCI = Continuous Commodity Index), the S&P500, global bonds (Barclays Aggregate) and US cash during these periods, by 1.1% each month on average, 0.8%, 1.3% and 1.4% respectively.

While low real rate regime and simultaneous declines in real rates is the best regime for performance, the low and rising scenario is still constructive for gold. Even if US real rates rose from here, this might remain constructive for gold. This creates confidence that we can identify when macroeconomic conditions turn from favourable to unfavourable in the future.

-

Recessions are rocket-fuel

I’d prefer to leave the analysis at real rates and relative valuations because this creates a compelling case for gold without mentioning anything doomsday-esque.

Gold tends to perform well during recessions (table above). As a result, gold is perceived by some as an “end-of-the-world” allocation and those advocating it are labelled doomsayers. This label is unhelpful and lacks nuance. In reality, gold performs well during recessions for clear and identifiable reasons, not because the “world is ending.” 1) economic growth and earnings falter which negatively impacts equities, property and any other growth sensitive asset class. On a relative basis, an asset which is proven to hold value over time (gold) does well during recessions. 2) Corporates and household default risk rises which can cause a tightening in liquidity and precipitate financial instability, creating left-tail risk that individuals won’t be able to access capital that sits under custody with financial institutions. 3) Central banks and fiscal authorities are bound to respond to the recession with further stimulus. Lower interest rates, central bank asset purchases and debt funded fiscal expansion are constructive for gold because they reduce the value of fiat currencies. If you’re supplying more currency, it becomes worth less over time. Cash is devalued by authorities, making the commodity alternative to paper money, gold, more attractive.

We are currently faced with the biggest global recession risk since 2008. If you’d like me to go into the detail, leave me a note in the comments. Important to note that the recession risks aren’t entirely on account of the corona virus. There have been numerous pent-up reasons for a potential recession (debt growth, capital misallocation due to low rates, overvalued equities, etc). Corona is a catalyst, not a cause.

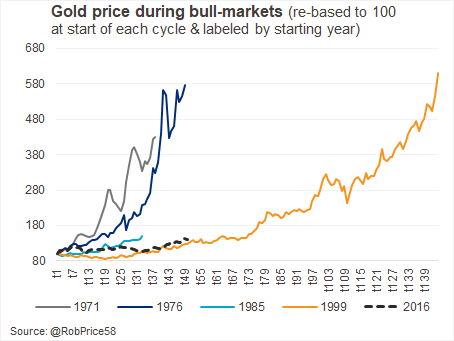

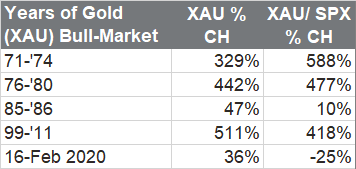

Breaking into the Meat of the Bull

Visualising past gold bull-markets, we’re at a similar length of time to 1971 and 1976 but have experienced significantly less price appreciation. The shortest and shallowest bull-market (defined as a 20% price appreciation) was 1985. For context, US real interest rates were at 5% during this period (below) so it doesn’t resemble today’s conditions. Given the relative valuation, real rates and recession risks, this bull-market will likely continue. Who knows how long it’ll continue but the price-appreciation of the 1971, 1976 and 1999 scenarios create a range appreciation potential around 280% from here (200% when considering the 1971 scenario). Once again, not forecasts, just indications of potential.

The table below of gold performance (and relative gold performance vs. the S&P500) supports the claim that we’re very early into the bull-market. Gold hasn’t yet matched up to the 1985 cycle yet.

If you follow me on twitter you’ll notice that I use technical analysis to provide an indication of market momentum (I am not a tech trader). Technical analysis shows that gold was been in a downward sloping trend vs. the S&P500 since 2014. Between mid-2019 and early 2020 gold tried to break out of this underperformance cycle, hitting up on that trend line. Finally in Q1 2020 gold made a clear breakout from the trend line and is now quickly catching up lost ground vs. the S&P500. The 2016 highs in this ratio will be scaled very soon and we’ll probably experience some consolidation around there. But don’t be surprised if the 2012 relative levels come in the quarters thereafter.

These relative asset class ratios are important for investors because equity is usually such an important component of long-term portfolios.

Portfolio Rationale | Positive Real Return Hedge

I’m often asked, “What is the purpose of gold within a portfolio?” Is gold included within allocations to generate returns or hedge against broad market risk? In truth, it’s a bit of both. As we’ve seen, gold mitigates against over-valued traditional asset classes, low real interest rates and performs particularly well during recessions. Therefore, it has hedge characteristics. But making an investment primarily as a market hedge is difficult for many long-term investors. Young people, for example, who feel compelled to focus on growth within their portfolios. So we have to appreciate both sides of the coin.

Real Return Characteristics

Gold maintains purchasing power relative to CPI (first graph in article), in both South Africa and the United States, through numerous market cycles. It is expected to provide positive real return characteristics and should be considered when real return expectations on other asset classes are low.

Gold competes with equity

Gold has outperformed the S&P500 since Jan 1972, which suggests that gold can provide equity-like returns (graph below). The performance cycle is just very different to equity with large periods of under performance and out performance. And this is precisely why gold is such an attractive investment prospect within bonds and equity focused portfolios, diversification!

Diversification reduces portfolio risk

Taking the traditional 60/40 portfolio with a 10% allocation to gold (54% global equity, 36% global bonds and 10% gold, with monthly re-balancing) results in almost exactly the same returns as the 60-40 since Jan 1970. In fact, the new portfolio outperforms with 7.29% annualised returns vs. 7.16% for the 60/40 portfolio. Risk statistics improve for meaningfully. The maximum drawdown over a 3-year rolling period is -33% vs. -37.5% (60/40), the minimum 1-year rolling return is -30.7% vs. -33.6% (60/40) and the minimum 5-year annualised rolling return is 1% vs. 2.5% (60/40). There are clear portfolio benefits to gold allocations because of the real return and diversification characteristics.

Gold is notoriously volatile

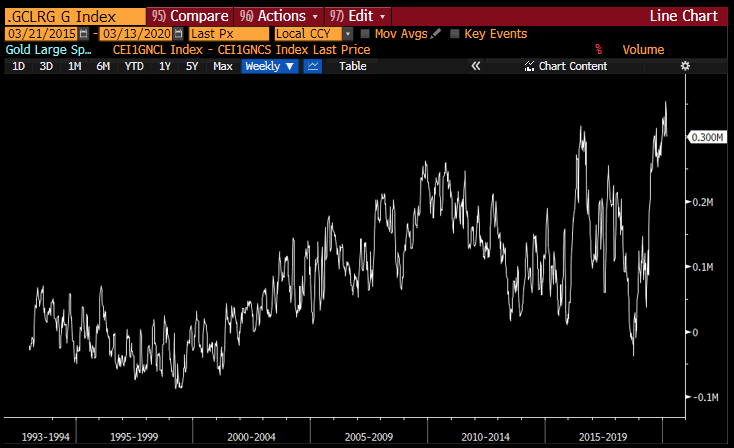

Gold reduces portfolio risk but volatility should be expected on the asset itself. The standard deviation of monthly returns since 1970 is 5.6% vs. 3.7% for the CCI, 4.3% for the S&P 500, 6.4% for the MSCI World, 1.8% for US Treasuries and 0.3% for US cash. In fact, current speculative long positions on gold (below) suggest that the price could come under short-term pressure if these speculators are forced out of their positions. Gold is not for the faint-hearted or those who expect stable returns similar to peers every trading day.

Compelling opportunity to protect capital

I’ve avoided talking about gold with friends and family for years due to the social stigma. When people think of gold, many see a creepy selfish man counting coins in his basement. Well, we’ve come to the point where the case for gold is so compelling that I no longer care about the social stigma. There are strong fundamental reasons for gold allocations, it just requires one to take a slightly different approach to investments. Still rational and data driven, but not purely based on discounted cash-flows and yields. Gold has attractive relative value, low US real rates are constructive and recession risks are a further catalyst. Its unhelpful to fall in the doomsday-esque trap when considering these factors. Look at the portfolio characteristics of permanent allocations, combine this with the clear cyclical value and you have a compelling opportunity to protect your capital.

If you’ve got comments or questions, please send them through.

August update here.

3 thoughts on “Protect Capital; the Case for Gold”