TLDR: Emergent crypto banks offer an attractive opportunity, which highlights the innovative potential of crypto vs. ridiculously low rates and high fees in traditional banking. Obviously, crypto yields don’t come without their risks. One could even argue that centralised finance is completely against the ethos of bitcoin. KYC, custody, credit risk and ethical concerns must be balanced vs. the attraction. I expect large flows into BTC deposits, and perhaps even more into USD yield bearing deposits. I’ve invested into these yield bearing accounts to enhance returns, better understand the crypto ecosystem and the development of finance. [12-minute read\

DeFi or decentralised finance has gone ballistic in 2020. Conceptually, it sounds great. We’ve got decentralised cryptocurrencies like bitcoin and Ethereum and now people are trying to build financial services on top. There is lots of capital sitting in cryptocurrencies and there are others who want access to capital. Lending markets allow these two parties to meet in the middle and exchange value through interest rates.

I’m pretty conservative so I started my journey through understanding centralised finance in cryptocurrencies, rather than full-blow decentralised finance.

Centralised institutions provide a conduit through which crypto holders can deposit their funds and earn interest. These institutions lend out funds to businesses, traders, investors and individuals who put that capital to work. Borrowers pay a higher interest rate than lenders receive, which allows the centralised institutions to earn the spread. In other words, a centralised banking system has emerged in crypto. These institutions present a potential opportunity for crypto holders who want to “put their capital to work.”

I’ve spent a fair bit of time researching BlockFi, which is one of the most experienced institution in this space. The rest of this article speaks specifically to BlockFi’s product offering.

Incredible Yields on Offer

Bitcoin depositors can earn 6.2% on deposits up to 5 bitcoin, and 3% on funds above 5 BTC. This is impressive! Obviously its not without risks, which I outline below, but there is clearly an attraction. Depositors remain exposed to bitcoin, which is good, and they earn a yield pick-up.

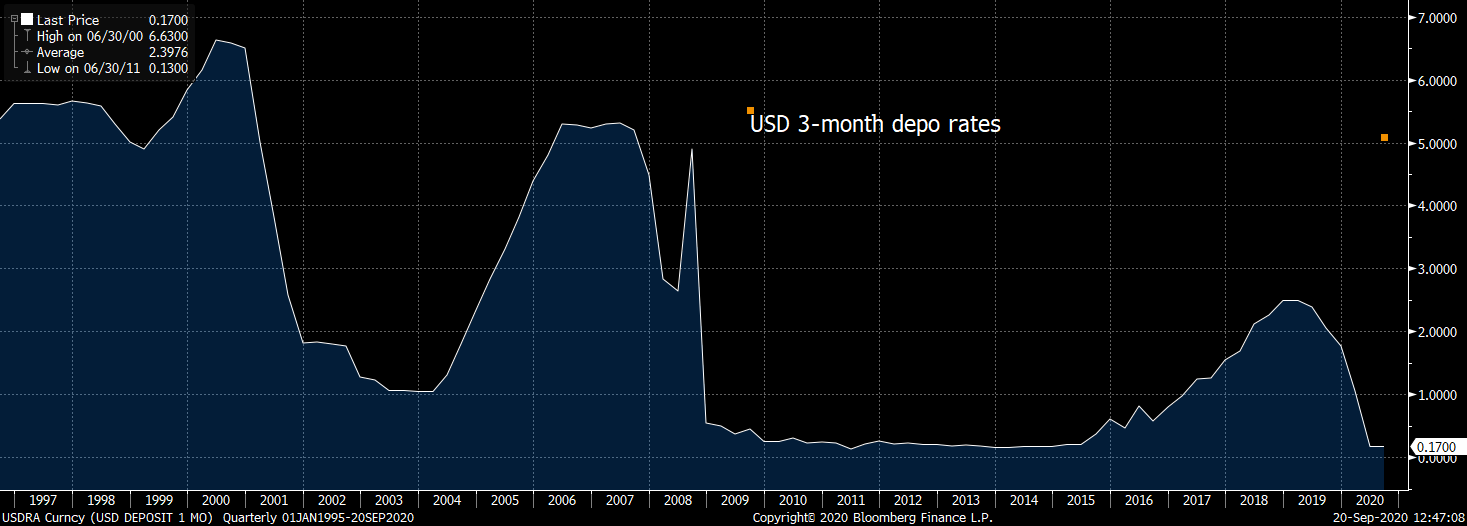

On USD, depositors can earn 8.6%. That’s INCREDIBLE! Yields on the 10-year US Treasury are currently 1.5% and the 3-month deposit rate is 0.17%. In crypto you can deposit and withdraw with very limited notice period and earn 4X US Treasuries. This is a massive opportunity for individuals, businesses and investors who are sitting on hoards of zero interest cash. I’m not sure what BlockFi’s capacity constraints are like, but this seems like a no-brainer for many moderately sized USD deposit holders.

Let’s go through the concerns

- Capital doesn’t necessarily need to be “put to work.” There is nothing wrong with hoarding capital. If one believes that bitcoin is working towards an alternative monetary system, which could end the inflationary madness of centralised monetary & fiscal policies and their nefarious consequences, then there is a very strong argument to avoid crypto lending. Buy as much bitcoin as possible, store it away safely (off-exchange), wait for the fireworks in the fiat monetary system and don’t get too greedy trying to enhance returns. This is the argument taken by many bitcoin Maximalists and I am heavily swayed by it.

- Taking this further, one could argue that centralised lending completely defeats the ethos of bitcoin. Used appropriately, bitcoin allows each user to become his/her own bank and remove extractive financial institutions from the equation. Putting funds into a custody account implies that you no longer the holder of the private keys and you must request permission to move your funds. This is not ideal.

- A centralised money lending institution is subject to anti-money laundering (AML) and know your client (KYC), which implies they will collect your data, negatively impacting your personal privacy.

These 3 concerns are unacceptable for many bitcoiners. But many others already store their BTC on exchange or in custodial wallets and have very little care for their data privacy. This category of investors won’t be overly concerned by depositing their bitcoin into a centralised crypto bank.

- Depositing crypto into a lending institution is basically an investment into their lending practices. If the risk management solution works effectively, you’ll receive your yield. If it doesn’t work, the business comes under financial difficulty and it may have trouble honouring commitments to deposit holders. Financial difficulties could trigger an old-fashioned bank run in crypto banks. While these institutions are regulated, they certainly aren’t part of the fractional reserve banking arrangement with the central bank. Lender of last resort arrangements prevent bank runs in traditional banks like Chase, JP Morgan, FNB and Absa. The Fed or SARB provides liquidity to stop bank runs, if required. Crypto banks won’t receive the same treatment.

- Prudence dictates that we need to know how these crypto lending institutions are making their money, who are they lending to and how are they able to make these returns.

Even though they are a pretty reputable institution with big backers (Gemini, Valaar Ventures, Winklevoss, Galaxy, Consensus, Avon and Morgan Creek) they aren’t prepared to provide reems of information on their lending practices. They deem this data intellectual property, which in understandable. So, one must dig around, formulate a picture, and the rest is a risk-return-uncertainty trade-off.

How BlockFi makes money

- BlockFi makes USD loans (collateralised with BTC) and charges almost 10% on these, so there is a 1.4% spread above the 8.6% they’re offering on USD deposits.

- BlockFi doesn’t reveal the rates they charge on BTC loans, but we know that they’ll also be higher than the 6.2% offered in BTC deposits.

- BTC loans are a sizeable risk on BlockFi’s books because a sudden appreciation on the BTC price makes repayment of these loans very expensive. It would be imprudent to lend this type of credit to an inexperienced business. Therefore, BTC loans are only provided to institutional clients and there is a vetting process where BlockFi assesses the history of the business, their business model and strategy for BTC loans.

- The majority of BTC lenders use the capital to implement short-term arbitrage trades between large exchanges. For example, there could be a discrepancy between the prices on Kraken and CoinBase. BlockFi’s BTC-loan clients will implement buy BTC on the exchange with the lower price and sell BTC on the exchange with the higher price. They require large BTC funds across different exchanges at short notice in order to be positioned to make these types of trades. Hence the need for access to large pools of liquidity from BlockFi.

- All BTC loans are short-term loans so if BlockFi’s BTC reserves are depleted, it can liquidate BTC loans to improve liquidity. Note here, there is no maturity-miss-matching in BlockFi’s lending practices.

- All loans are collateralised. Automated margin calls are triggered if the collateral falls below a certain threshold value vs. loan.

- For example, if a BTC depositor has taken out a USD loan, but the BTC price falls too far, then the customer will be asked to add margin (add BTC) or repay some of the USD to bring the loan to value ratio into an acceptable range. If this isn’t possible then the collateral (BTC) can be liquidated and the arrangement terminated to ensure there isn’t a delinquency.

- As another example, a BTC lender is required to post USD collateral. If the BTC price moves too high, then the lender is required to post more USD collateral or liquidate the loan to achieve an acceptable loan to value ratio.

- A major risk would emerge if there isn’t enough demand for the higher interest rate loans as BlockFi would become squeezed by the monthly deposit pay-outs. This also isn’t an easy risk to mitigate against. If BlockFi were to become squeezed it may be compelled into lower quality loans to less credit worthy institutions to keep the game alive.

- BlockFi employs experienced smart people from traditional finance to manage the new process in the crypto markets. This interview with the Chief Risk Officer Rene van Kesteren is pretty insightful: https://blockfi.com/blockfi-news/blockfi-live-risk-management-overview/.

- Summary: The spread between lending and borrowing rates, the short-term structure of the loans and the collateralised nature of a loans significantly reduce BlockFi’s business risk.

I view a BlockFi interest bearing account as broad investment into the crypto ecosystem. A low risk allocation of your liquidity where you don’t have to seek out the specific arbitrage opportunities yourself. BlockFi will facilitate capital reallocation to trading firms, increasing liquidity and efficiency, with a yield payable to deposit holders in return. If these arbitrage and trading opportunities become scarcer, one needs to become wary about one’s investment, or perhaps expect a reduction in the yield. The way I see it, competition may bring liquidity and efficiency, which could drive down returns. Perhaps these risks also rise during a crypto bear-market when broader liquidity dries up, deposits flee and delinquencies rise? But this illiquidity may also present trading opportunities – so I need to give this a little more thought… Hopefully, BlockFi will release more frequent financial data so that we can monitor business performance during different crypto cycles.

Despite the lack of specific detail, there’s enough detail to be impressed by the business model. I’ve deposited some BTC with BlockFi to further understand the developments in crypto banking and earn a 6.2% on some BTC. I see this as far less important than allocating towards bitcoin itself. I don’t want to allocate all of my bitcoin into these accounts, revealing the full value on my crypto funds to centralised authorities. A degree of privacy is beneficial if you hold a fair amount of your capital in these markets.

Last thought, its possible that the USD deposits and the yields on offer have a bigger impact than BTC yields, attracting capital from zero yielding cash in traditional finance, serving as a gateway drug into bitcoin.

If you’re interested in BlockFi, use my referral code when you sign up so that we can both benefit with a few extra USD dollars. https://blockfi.com/?ref=73bb6bd7