Bitcoin has developed a strong correlation with “risk assets” in 2020. A stronger correlation between bitcoin and global equity markets is an understandable concern for those who consider bitcoin an independent store of value. In this article, I dispel these risk-asset fears. TLDR: the drivers of equity and stores of value can temporarily overlap, but this doesn’t imply an alteration in the fundamental characteristics of those asset classes, which are remarkably different.

A store of value can correlate with risk assets

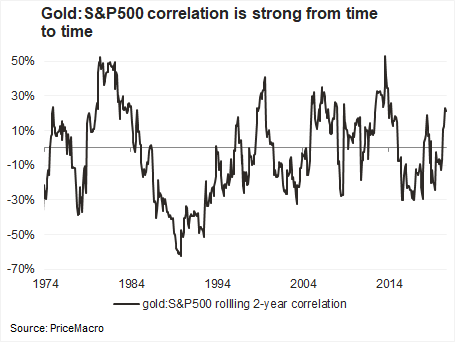

To start this analysis, let’s look at gold, the traditional store of value (if you’re struggling to understand “store of value”, please read this article). The drivers of gold and the S&P can overlap for periods of time. Conceptually, both benefit when inflation expectations central bank liquidity increase. Historically, the 2-year rolling correlation between gold and the S&P has been strong on a few occasions.

But despite the potential overlap in short-term drivers, the asset classes are remarkably different to each other. Through time, the correlation between gold and the S&P500 has always fall back towards zero on average.

Highest BTC-Equity correlation on record is eye-catching

Turning to bitcoin, the 6-month rolling correlation on m/m returns reached its highest levels on record in 2020 so it’s definitely worth noting. The conceptual reasoning is the same as gold’s; monetary inflation and liquidity are driving strong performance in bitcoin and the S&P500 at the same time.

I am unconvinced rising correlation is a permanent feature of these markets.

- The strong correlation only emerged in 2020.

- The correlation has averaged 11% historically. This is slightly higher than the long-term gold:S&P correlation of 0, but I don’t think that’s alarming. Since 2010 the gold:S&P500 correlation was 8.6%, so comparing like for like, there’s not much to right home about

- The asset classes are fundamentally different to each other.

Volatility to remain a defining feature but unconcerned by higher correlation

The recent rise in correlation suggests to me that BTC investors need to be cognisant of broader financial market volatility. If S&P500 drops, BTC will likely drop too because many investors may sell bitcoin in unison with the S&P500. But volatility should already be expected in BTC so this isn’t really saying anything new. The higher correlation hasn’t existed for long enough for me to alter my fundamentally bullish perspective on BTC.

I would prefer to witness a lower correlation, if I had a choice, but I do not have a choice… I am not overly concerned by the strong correlation and I’d be surprised if it remained there for an extended period. Currently, the correlation is falling again. Let’s see how it pans out over the coming months.

I’m happy to stomach the potential volatility due to the out-sized return potential and I don’t think that BTC-equity correlation fundamentally changes anything about bitcoin.

2 thoughts on “Dispelling bitcoin risk-asset fears”