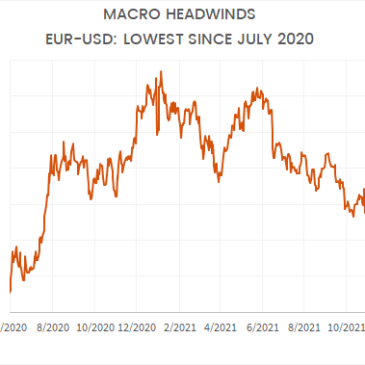

SM Market Review (Nov 2021): Macro headwinds build

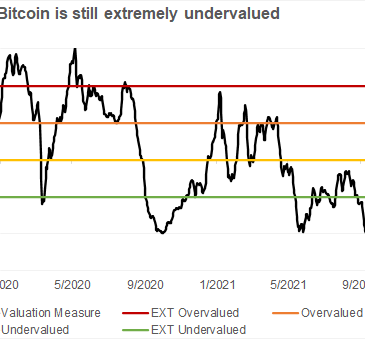

The traditional macro world took some steam out of bitcoin in November. Crypto investors may have shifted capital away from trad-fi, but trad-fi liquidity flows will remain critical in the months ahead. A stronger USD and flatter yield curve tell a cautionary tail as we edge deeper into the bitcoin bull-market. TLDR: Bitcoin fundamentals remain … More SM Market Review (Nov 2021): Macro headwinds build