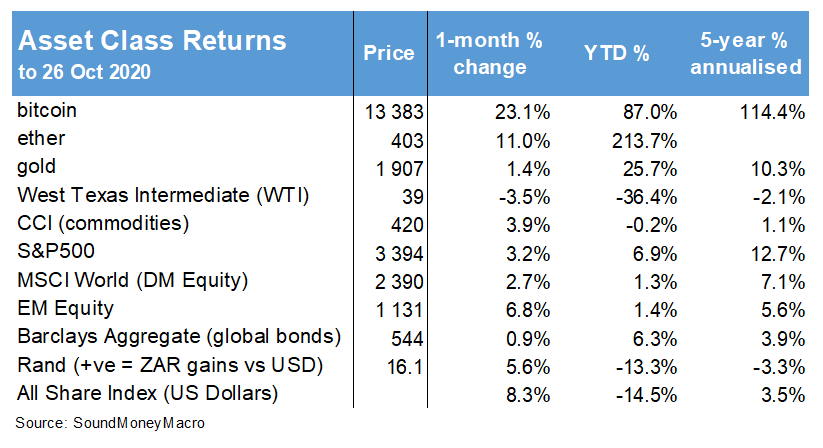

Since the August 14 Bitcoin Bulletin “Accumulation Phase Intact”, bitcoin has gained by 10.6% from $11,770 to $13,019. The data I’m looking at suggests we’re firmly in the accumulation phase with limited signs of market froth. Retail and institutional interest looks contained, which indicates the corporate treasury decisions and potentially High Net Worth’s are moving the needle on the price. PayPal’s decision along with price FOMO will probably pull retail into the rally over the coming quarters. Volatility is always a risk in bitcoin, particularly few new entrants, but I don’t think we’ll see sub-$10K again, which is a decent price floor. To describe my outlook as optimistic is an understatement. Its not just about price projections. It’s about the positive impact on a world that’s ravaged by unsound money. I continue to accumulate and support adoption.

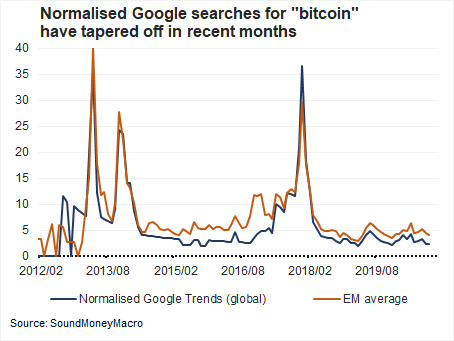

Quiet on the retail front

Google searches for bitcoin have fallen slightly in both EMs and DMs since August (I look at the normalised data because I searches have trended higher over time). This could be taken as a slightly negative price indication but it’s not a dramatic drop in interest. It also begs the question, “what is driving the price higher in the last two months?” Perhaps it’s the block reward halving and the resulting reduction in bitcoin supply? (Bitcoin supply growth is 6.25 per block, rather than 12.5 previously) Perhaps corporates, institutional finance or High Net Worth Individuals are buying rather than retail? Difficult to know exactly, but its worth contemplating to get a feel for the market.

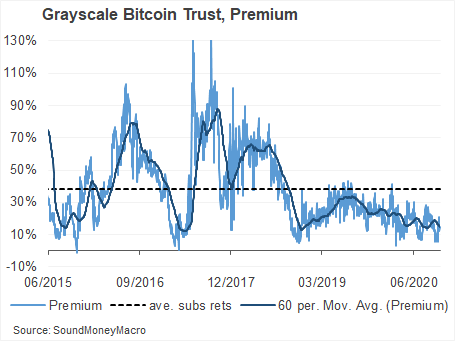

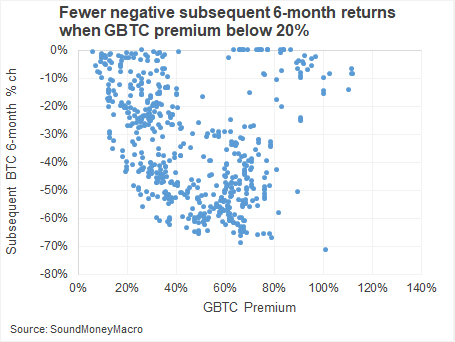

Downside volatility reasonably contained

The Grayscale BTC Trust (GBTC) is a favoured instrument for many institutional investors. The GBTC price fluctuates relative to the undervaluing value of bitcoin holdings and provides a useful indication of the strength of the market. There are times when investors are willing to pay premiums to gain exposure to bitcoin. Historically, low premiums have been a good time to buy bitcoin because subsequent downside bitcoin price volatility has been contained. I’ve shown the range of negative subsequent 6-month BTC returns vs. the premium below. Currently the spread is at 15%. One must always factor in bitcoin price volatility, but I do think downside volatility will be reasonably contained from current levels. Lastly on GBTC, the low premium could indicate HNW’s and corporate treasuries are influencing the price rather than institutional financial buyers. For more information on the Grayscale Trust read the full article from 24 October.

Eroding institutional barriers

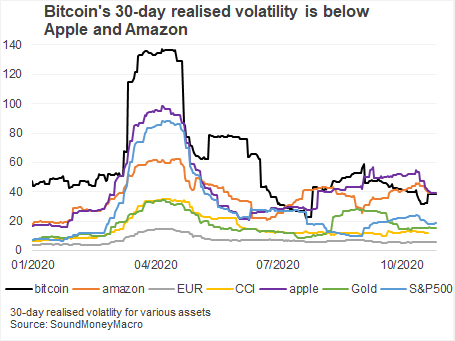

Sticking with the volatility theme, bitcoin’s 30-day realised volatility has fallen below Amazon and Apple. Elevated volatility was a concern for traditional investors in the past, but this argument is diminishing. The incentive for institutional participation is growing. From JP Morgan, “Even a modest crowding out of gold as an “alternative” currency over the longer term would imply doubling or tripling of the bitcoin price from here. In other words, the potential long-term upside for bitcoin is considerable as it competes more intensely with gold as an “alternative” currency we believe, given that Millennials would become over time a more important component of investors’ universe.”

Just the fact that JP Morgan is writing about bitcoin is noteworthy. I believe that institutional financial interest will grow through this cycle.

Risk-asset fears dissipating

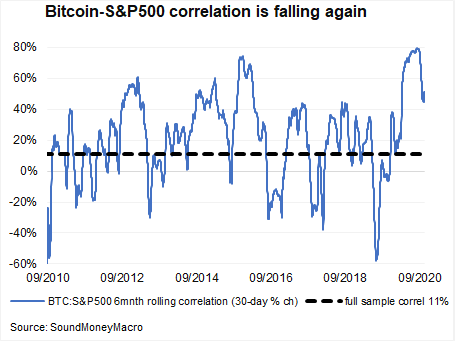

detractors were drawn to bitcoin’s strong correlation with US equities in recent months. This was an understand concern, but I wrote on 28 September that the elevated correlation was unsustainable. “The drivers of equity and stores of value can temporarily overlap, but this doesn’t imply an alteration in the fundamental characteristics of those asset classes, which are remarkably different.” Indeed, bitcoin’s correlation vs. the S&P500 has fallen in recent weeks as the S&P has taken experienced a pre-election breather while bitcoin has ratcheted up a notch.

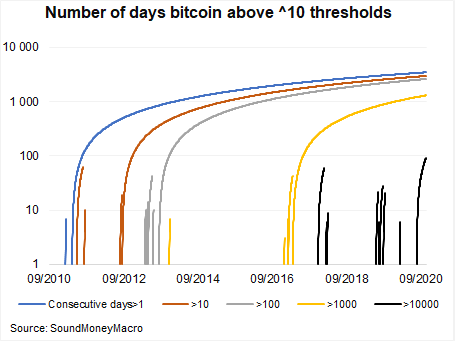

Above $10K for good

This has been said many times before (not by me), but I’ll temp fait and venture a forecast, I don’t think we’ll break below $10K again. As I said above, bitcoin volatility is ALWAYS a factor. 30-40% bitcoin price drawdowns should still be expected, even in bull-markets. A 30% correction from today’s price would take us back to $10K. Its been 92 days since bitcoin last fell below 10K. If we fall below it would have been the longest time above one of these psychologically important levels (1, 10, 100, 1000) without permanently holding above. You could argue that these levels are completely arbitrary, and you’d be right, but the market does tend towards support and resistance at seemingly psychologically important levels.

Corporate Treasury Store of Value

The big news since August are the announcements from PayPal and Square. Square has followed MicroStrategy in allocating $50mn of its Treasury assets to bitcoin. Square mirrored MicroStrategy’s rational, seeing bitcoin as a digital store of value. MicroStrategy CEO Michael Saylor has also been all over the airwaves in the past two months, espousing a powerfully bullish bitcoin narrative. He gets the capital allocation argument as well as any. I recommend that you listen to his podcasts. I particularly like this one with HedgeEye CEO of Keith McCoullough where he dismissed bitcoin trading.

MicroStrategy’s aggressive approach is compelling! The long-term store of value thesis in a world of ridiculous monetary inflation allows one to take outsized bets in bitcoin and digest volatility with steely confidence. This is why I recommend getting one’s head around the asset allocation, macro and social trends. Once conviction is achieved on those trends, bitcoin becomes obvious.

Numerous corporate treasury’s will have noticed Square and MicroStrategy and will be under pressure to follow. Granted, MicroStrategy and Square are both tech savvy, but they’re not alone in this knowledge base. The Truth is, any corporates sitting on large cash stocks should be asking themselves the same questions and investigating the possibility of allocating lazy cash into bitcoin. The sooner you start the conversation, the better. It’s a 6-month journey, at least, for a large corporates.

Marketing ‘bitcoin’ through 26mn merchants

PayPal’s announcement is exciting but different. U.S. account holders can start buying and selling cryptocurrencies in “the coming weeks” while there are plans to expand “this to Venmo and some countries in the first half of 2021.” Paypal has 26 million merchants registered. This kind of bitcoin marketing will drive awareness. However, PayPal customers won’t be able to withdraw their bitcoin from their PayPal accounts, which takes the shine off the announcement. Many users don’t care about self-custody of their bitcoins, but part of the bitcoin ethos is the ability to withdraw your bitcoin and store it yourself (aka self-custody). Self-custody allows you to act as your own bank. Even if you don’t exercise this right, it’s important that exchanges offer it to you. Serious bitcoiner’s won’t use PayPal services due to this constraint. They’ll ask themselves questions like, “what’s to stop PayPal selling more bitcoin than they actually own?” which is a difficult question to answer without getting costly auditors involved. Fractionally lending more bitcoin than exist, is a bitcoiners worst nightmare.

Until PayPal offer withdrawal services, I’d only recommend using PayPal’s bitcoin service if you don’t have an alternative. Exposure is better than none, but there are better ways to access and store your hard-earned value. It’ll be fascinating to see how this space evolves. US banks are going to be hot on PayPal’s tails, offering their own custody and sales services. Which side of the ideological divide will they fall, will they buy into bitcoin’s ethos, and how much attention will they receive in their products relative to the existing exchanges? Lastly, these developments further solidify bitcoin’s institutional credibility and reduce the chance of a sudden raft of negative regulation, which is always at the back of bitcoiners minds’.

All aboard

The bitcoin train continues to steam role ahead. Obviously, I’m biased, but I’m also sceptically looking closely at the data for signs of a frothy market, which would spell extended weakness. Bitcoin has been on a strong run to $13K so a pull-back is possible, but I’m strongly of the opinion that we won’t fall below $10K. Dips are buying opportunities, which I am happy to take advantage of despite my concentrated holdings in this asset class. Where else am I going to store my value? I’ve been writing in my monthly newsletter that “sound money is the challenge of our lifetime and bitcoin is the opportunity to respond constructively to that challenge.” If you have any interest in managing your personal finances and aren’t living pay-check to pay-check, your allocation should be greater than 1%. In the Sept 18 article “bitcoin is a no-brainer: get off zero” I painted a few portfolio scenarios with basic global and South African investment portfolios. I recommend that those with moderate levels of investment savvy take a look.

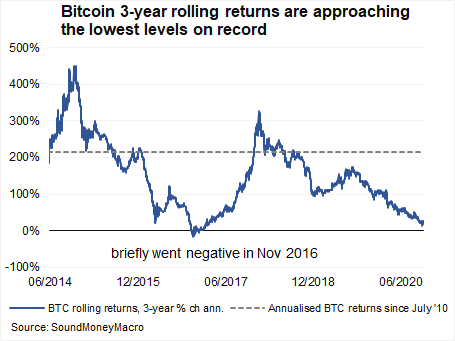

I made a number forecasts in the last time, so I’ll keep it short here. I think there’s a strong possibility of a new all-time high in the next 4 months, which would imply the 3-year rolling % change shaves but barely turns negative, which is similar to the Nov 2016 experience.

Please critique, share and most importantly, have a great week ahead!

One thought on “Bitcoin Bulletin: All aboard the train”