In 2021 El Salvador became the first nation to adopt bitcoin as legal tender, a monumental occasion on bitcoin’s monetization path. Despite this encouraging development, I do not think we are going to see many major nations following in its footsteps just yet. Small, dollarized countries will be tempted. But for the vast majority of governments, the appeal of a centralized currency is too strong to hand legal tender status to bitcoin. Nevertheless, there is potentially another source of state-level demand. I expect that ‘Rogue states’ like Russia, Iran and China are looking closely at bitcoin as an alternative global settlement network to the USD. In this article I highlight the reasons why I think this is an important next development to monitor, and cover some of the consequences. TLDR: Rogue state demand is potentially a major bullish price catalyst, and at the same time it is a PR nightmare for bitcoin in the west. It is critical to return to the principles guiding your decision making to ensure you are not caught up in the inevitable PR nightmare this catalyst will present. Bitcoin’s detractors will jump on the opportunity to call the technology un-American or anti-West.

The world revolves around the US dollar

The USD as been the centre of the global economy since the Bretton Woods agreement in 1944

Everything is denominated in USDs; trade, debt, finance. This implies USD exerts incredible control and influence as US monetary and fiscal policy impacts everyone in every country around the globe. If the US dollar strengthens (weakens), or US interest rates rise (fall), or the US budget deficit narrows (widens), then global monetary and financial conditions tighten (loosen).

Most governments around the world have benefited from this arrangement, because US monetary and fiscal policy have loosened as a trend since the 1970s, allowing every other country in the world to loosen policy themselves. Governments like to loosen policy because it offers them power and tools to expand and execute their economic agenda.

Negative consequences of Unsound Money

As readers know well, the man on the street is the major loser from looser monetary and fiscal policy (unsound money). The insidious consequences of unsound money include overvalued asset classes, speculative investing, difficulty saving, inequality, environmental degradation, etc. But the man on the street is not the only loser in the USD dominated world order.

The USD reserve system has a particularly negative impact on enemies of the US (Rogue states). The US and Western nations use the USD to exert control and influence through sanctions and can even go as far as to cut countries out of the SWIFT payments network. The best recent example of this was in Iran which went through a sharp economic depression and high inflation in the face of sanctions. Obviously, sanctions were not the only cause of Iran’s economic hardship, but the political response globally made conditions particularly tough.

One can easily argue that this policy intervention is a good thing, if you do not like those countries, but let us put value judgement aside for now. I merely want to establish that certain countries do not like USD reserve currency status and the power it exerts over them.

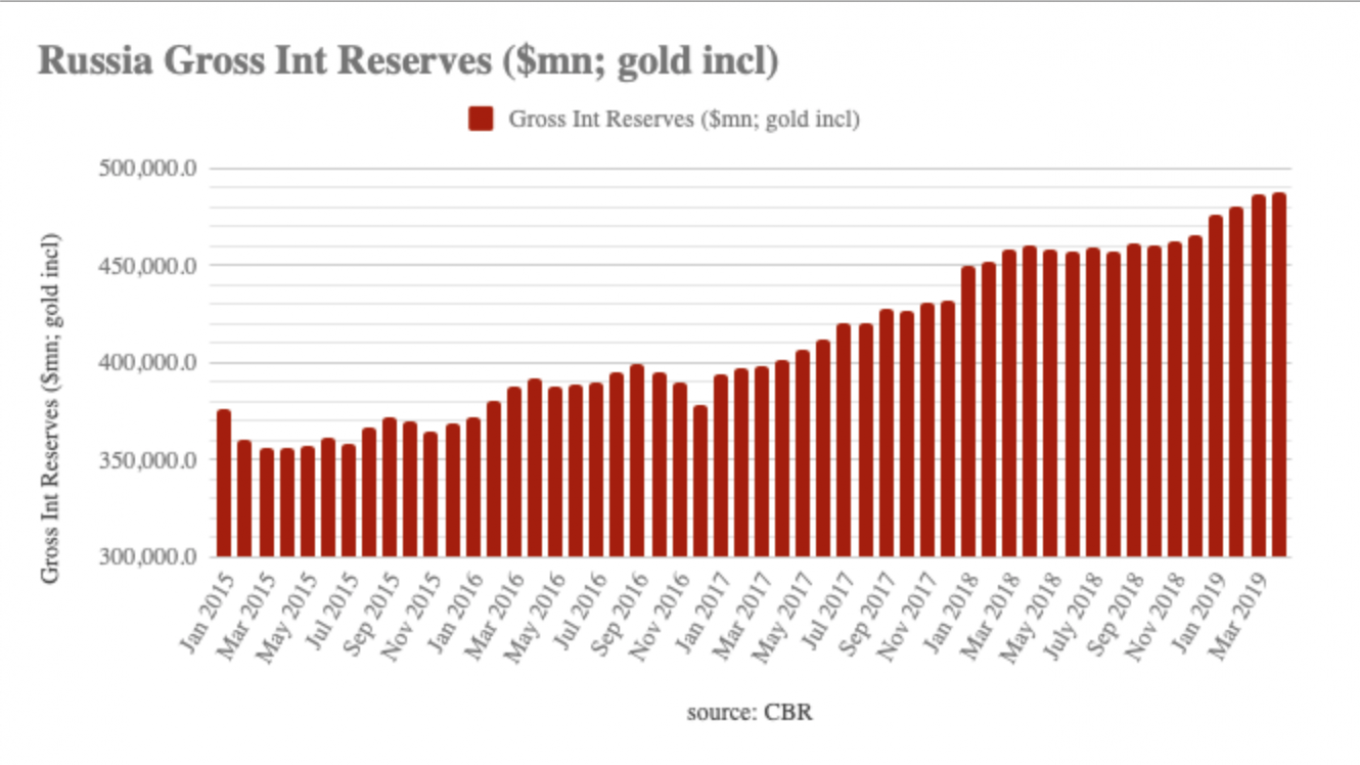

Humans react to incentives and those countries in opposition to USD hegemony will look to alternative monetary networks on which they can settle trade, price debt and conduct finance. Historically, these states have accumulated gold in an attempt to diversify their currency dependency. For example Russia accumulated significant gold reserves in the past 10 years. China is reported to have accumulated large unreported gold reserves too.

Bitcoin presents a powerful opportunity for currency diversification

Not only is bitcoin a decentralized store of value, its a censorship resistant payments network. I.E. Transactions cannot be censored by a centralized intermediary. It is a no-brainer that entities which are excluded from a financial system will turn towards bitcoin at some point. This includes unbanked people in poor countries, political opposition in authoritarian countries and ‘rogue states’ which are excluded from the USD settlement system.

Prepare for the PR Nightmare

If it comes to fruition, rogue state demand for bitcoin says nothing about bitcoin itself. Many criminals use BTC, the EUR and the USD - for example - this says nothing about the currency. But not many journalists and politicians will appreciate this perspective. Bitcoin’s detractors (of which there are many) will likely use rogue state adoption as a stick to beat bitcoin with, calling it un-American and anti-West. Holders will face a real test under this weighty narrative and we must prepare in advance.

Do not shoot the messenger - BTC is a technology that advances freedom

BTC is a technology based on sound principles, advocating for financial transparency, security, scarcity and rewards based on work. Those principles are in conflict with fiat currency, which allows the people who control the money to use it for their own ends and inevitably leads to a lack of scarcity, dilution and corruption as special interest groups in society scramble to win favour from those in power.

BTC will show the flawed principles of all fiat currencies over time, which is a good thing. The weakest currencies come under the most pressure because they have been most mismanaged, like Venezuela, Nigeria and Turkey. Larger currencies are far less threatened because bitcoin is tiny vs. the USD, EUR, JPY or GBP. But if the trajectory continues in the way it has over the last 10 years, these currencies will eventually put themselves under threat too.

Bitcoin’s collision course with the flawed principles of fiat currencies does not imply that it is a anti-Venezuelan, anti-Turkish or anti-US technology. Turkey decided to mismanage its currency and it is now dealing with the consequences.

Besides, the foundational principles which make America America, are not necessarily synonymous with the principles of fiat currency.

What principles do you stand for?

The US had numerous currencies before the USD and most Western countries have also been through various iterations of their monies. The reason any country is able to survive and thrive after changing currency is because the principles that tied those people together advanced them to a better technology

It is easy to associate America with the USD, but if America means anything it should stand for the principles that bind the country together. This obviously means different things to different people. But Liberty, freedom and the pursuit of happiness tend to be the key features of America. So, perhaps a better question is, “the USD reserve currency system aligned with the foundational principles of America?”

Once again, many journalists and politicians will not ask themselves these questions. But as custodians of capital and responsible humans we are compelled to ask and answer them. Plus, we must be prepared because society will demand the answers when the moniker anti-American gets thrown around.

Bullish catalyst on the horizon

Bringing this all back to bitcoin and markets, nation-state adoption of bitcoin is very price positive, no matter the purchaser. First, rogue state demand is an incredible proof of concept for the technology, despite the PR risks. Second, these entities will soak up plenty of demand if their allocation grows.

It does not make sense for these entities to announce any purchases until they are forced to do so. So, we will probably only figure it out after the news. But it is something to be aware of when watching price, volumes and markets over the coming months. I expect there could be some big bidders as bitcoin tests the $30K mark. Large financial institutions for sure, but potentially a rogue state or two.

*The featured image for this article comes from BTC Manager

2 thoughts on “SM (ed.19): Rogue State Demand?”