The traditional macro world took some steam out of bitcoin in November. Crypto investors may have shifted capital away from trad-fi, but trad-fi liquidity flows will remain critical in the months ahead. A stronger USD and flatter yield curve tell a cautionary tail as we edge deeper into the bitcoin bull-market. TLDR: Bitcoin fundamentals remain strong and trad-fi risks are unlikely to dominate immediately, but do not get complacent.

Last month when bitcoin was at $61.3K I said:

After the strong rally, bitcoin undervaluation has narrowed from close to 50% undervalued to 25%. We are still in extremely undervalued territory but obviously today is different prospect to where we were a month ago (end of October). Our medium term indicators are still supportive of the price outlook over the coming quarter. The conclusion being that there is a lower probability of a >25% correction under these conditions.

This has proven somewhat accurate as bitcoin has not fallen more than 25%. We have come close to this though, experiencing a 22% correction from a new all-time high at $69K early in the month to $53.3K.

What caused the decline in prices?

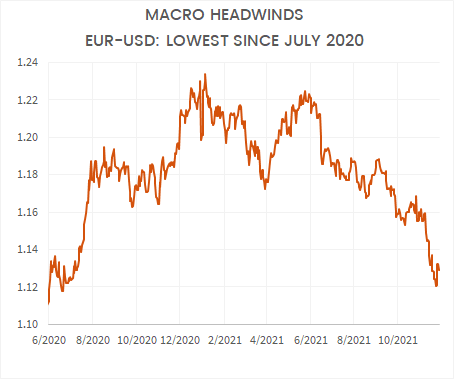

A stronger USD filtered through from trad-fi into bitcoin

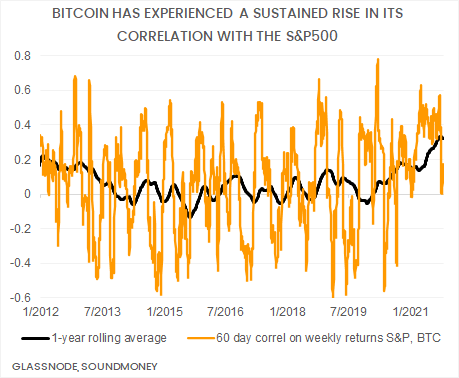

This months think-piece touched on the rising correlation between traditional financial markets and bitcoin (follow the link for more detail).

What happened?

The EUR has fallen approximately 7% vs. the USD in the past quarter and 3% over the past month. The USD is a bell weather for global monetary conditions and a tighter USD is not good for risk appetite.

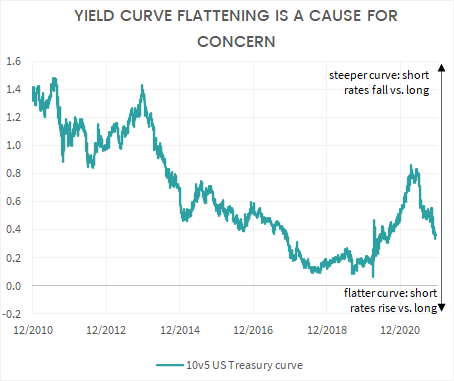

The US yield curve has also flattened sharply as front end rates have priced in the possibility of tighter Fed policy over the coming years. A flatter yield curve is a late cycle indicator and can spell trouble for risk assets like equity.

While bitcoin functions as a independent monetary network for some, it certainly functions as a risk asset for others. Bitcoin’s correlation with these macro variables is clear and should no be ignored.

Macro headwinds rising but impact not felt immediately

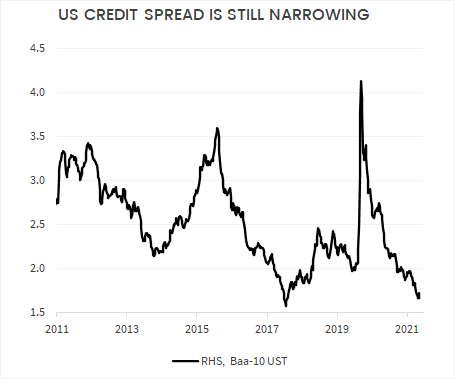

My current assessment of global macro conditions is that this is the first shot across the bow and that further macro induced volatility will take place in the next 12 to 18 months as the Fed tries to navigate tighter monetary policy. I do not think the Fed will get very far in its tightening efforts before it backs off - but the change in sentiment is still important to monitor. I still think that risk appetite will likely remain elevated as a trend over the next 6-9 months because liquidity is flush and real interest rates are very low, which will be supportive of bitcoin and crypto markets more generally. Credit spreads support this view.

Remain vigilant; this is not a time for complacency

If the USD continues to strengthen and the yield curve flatten, this would warrant a reassessment of bitcoin price expectations for the next 6 to 9 months. Bitcoin will not hold up well in the face of a sharp deterioration in global risk appetite across global financial markets and it would be foolish to ignore these developments just because bitcoin is undervalued.

Bitcoin fundamentals remain strong

Apart from the reduction in global risk appetite, bitcoin fundamentals are strong. Valuation is healthy, profit taking limited and liquidity is tight. It is unusual for bitcoin to undertake corrections greater than 25% under these conditions so I will stick by my view that bitcoin will find a price floor before that - probably in the low $53K region.

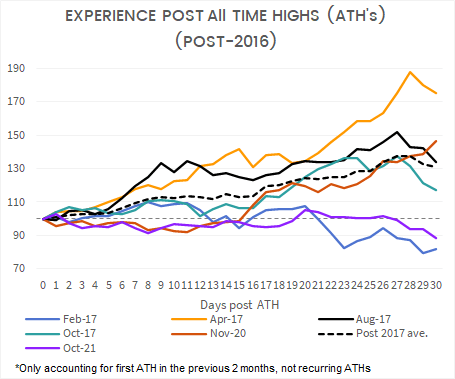

FOMO-induced post-ATH rally did not materialise

Interesting to note that bitcoin marked two new all-time highs in October and November but failed to experience the normal aggressive FOMO-induced rally thereafter. One experience does not prove a rule but I am constantly on the look out for signs that the market structure has changed

ETH shooting higher vs. BTC at month-end

On the ETH front, ETH/BTC gained marginally through most of the month, which aligned with our expectation for a reasonably flat pair. ETH has shot higher vs. BTC at the end of November though, which is a trend we expect to continue into the new year as new participants pour into what they perceive as more exciting segments of the market with lower nominal prices and higher recent return history’s. ETH is also experiencing a technical liquidity squeeze of a bigger magnitude than BTC at the moment.

Good luck out there!