This is a technical financial market article, French for lay-people.

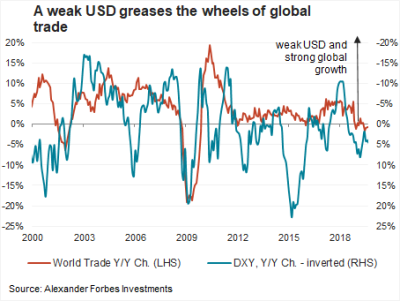

There is a tension between long-term and short-term forces on the world’s global reserve currency, the US dollar. The outcome is incredibly important for the global economy, asset class performance and investment outcomes across the globe because the USD is the funding currency for international trade and finance. A weak dollar greases the wheels of global finance and trade – USD weakness is an effective stimulus. While a strong dollar can be a wrecking ball, causing defaults and bankruptcies, if global debtors aren’t able to repay their USD debts. Short-term strengthening pressures remain, despite long-term weakening pressures and the Federal Reserve’s unprecedented attempts to reflate the global economy with the most substantial stimulus on record in March 2020.

Conclusions

- Bearish USD long-term supportive of long-term allocations to EM equity, EM bonds and commodities

- Concerned with short-term USD strengthening risks

- US income funds remains an important asset class, and probably US bonds for those who are willing to trade a further decline in rates

- Global risk appetite to remain constrained until USD risks alleviated

Long-term USD demise

Traditional currency valuation metrics like purchasing power parity, which measures relative price differentials, suggests that the dollar will depreciate over the years ahead. The US has created more currency and inflation relative to its trading partners. The US also has substantial un-funded social liabilities, which will likely require further monetisation of government debt. Long-term, I’m confident in USD weakness, which is one of the reasons that EM equity, EM bonds and commodities are such attractive long-term prospects. The Fed’s unprecedented balance sheet expansion in March 2020 suggest that the short USD is a one-way trade. However, shorter-term there is a shortage of USD dollars within global funding markets, which risks creating a dollar short squeeze and could send it much higher. And if the USD is going to tank, what will it decline against? Gold and bitcoin, sure, but are EUR, JPY or CNY ready to compete for global reserve currency status? Not a chance!

The murky Eurodollar markets

To understand the reasoning for the short-term USD strengthening risks, I’ll share with you my understanding of the Eurodollar market. Jeff Snider of Alhambra Investments, my eurodollar guru, says, “its a catch-all phrase to describe the evolution of the monetary system from a deposit-based system towards interbank liabilities.” (Almost all of this information comes from Jeff’s interviews with Eric Townsend on the Macro Voices podcast and Jeff’s articles on the Alhambra website. I’ve also started listening to Jeff’s interviews with Emil Kalinowski on youtube). The Eurodollar (ED) market emerged to facilitate global trade and became a way for banks to issue USD without underlying deposits. Large global banks capitalised on different regulatory regimes between Europe, the US and Asia, moving their major funding operations into the shadows, away from national regulatory regimes. This made central banks and regulatory authorities less relevant over time, which is an early insight into the difficulty faced by the Fed in trying to “solve” the current liquidity crisis. It sits outside of US regulations and is difficult to track with national money supply metrics.

Repo and Shadow Banking

Repurchase (repo) markets are an important component of the Eurodollar market. Banks conduct repo transactions with clients to generate liquidity, exchanging less liquid securities for cash so that the cash can be used elsewhere. Large corporations could minimize their demand deposit balances by placing excess funds each day in the short-term money market. One way to do this is by arranging a repo, a secured placement of immediately available funds in which the borrower sells securities to the lender and agrees to repurchase them at a predetermined price at a future date (often the next day). Such a transaction between a corporation and a commercial bank would convert a corporation’s demand deposit asset into an interest-bearing asset that would not be counted in any of the current or proposed aggregates. Hence, shadow banking.

Over time, the repo transactions started to act monetarily. I.E. banks would use the collateralised securities as a form of money, rehypothecating them several times to create a money multiplier. This was particularly prevalent in the Eurodollar market where the repo securities would serve as collateral for the expansion of off-shore USD supply.

Basel and Regulatory Complexity; the illusion of risk management

Prior to Basel, bank regulation had focused on liabilities; how many reserves and cash on hand in order to mitigate against runs. Banking complexity, rehypothecation, etc, made it increasingly difficult to define money, making the liability driven approach less effective. Basel introduced global banking regulations and switched focus from liability to asset-based regulation to try and catch-up with banking. Regulators hoped that if they mandated banks to hold high quality assets, they could reduce systemic risks.

Basle defines capital standards so that they can differentiate good from bad banks during crises. 4 risk buckets: 1) commercial loans (100% risk weighting), 2) qualified mortgages and ABS rated A or above (50% risk weighting), 3) structured tranches AA or AAA (20% risk weighting) and 4) cash and OECD sovereign obligations. The higher the risk of the asset, the more capital that is required in order to make the investment.

Profiting from loopholes, expanding USD supply

Financial institutions look for loopholes so that they reduce their capital requirements, create leverage and profits. They’d link securities together then, lower the bucket and reduce the capital requirements, but these actions weren’t necessarily less risky. Banks started playing with their balance sheets in order to circumvent Basel regulatory requirements. Regulations would affect capital allocation decisions, making the assets where the category could be manipulated more attractive. The use of qualified counterparties contributed towards this process as they would also have a lower risk weighting. With CDS’ the full notational value didn’t need to be reported, only the mkt-mkt, so the full leverage was hidden. I.E. Regulated institutions would comply with the Basel requirements but they’re have more risk sitting on their balance sheets in the shadows.

For example, AIG shifted from an insurer to a money dealer and rehypothecator. Approximately $379 billion of the $527 billion in notional exposure on AIG FP’s super senior credit default swap portfolio as of December 31 2007 were written to facilitate regulatory capital relief for financial institutions primarily in Europe. I.E. It was a major player in the Eurodollar market. The Fed could never have let it go under. AIG wasn’t insolvent when the Fed came in but the revaluation due to higher credit risk made AIG completely illiquid. Similarly, banks were well capitalised during the crisis but heavily leveraged.

Basel didn’t work in 2008, what’s different in 2020?

The Basel regulatory requirements didn’t quite work in 2008. Yes, the Fed averted banking failure in 2008/2009, using low rates and liquidity to paper over the cracks but the underlying monetary and financial system remained the same. Post the crisis Basel 3 tightened regulatory requirements from Basel 2 to ensure greater to tier 1 capital holdings, US Treasuries and German Bunds. These measures probably imply that systemic global banking risks are lower during this crisis than the GFC. But the challenges faced by banks in navigating the various pools of liquidity or illiquidity during crises remains unchanged.

Collateral, which is an important element of banks’ ability to leverage, became scarcer after 2008. Mortgage bonds were a big portion of the collateral market but were downgraded. EU sovereign bonds were downgraded during 2012. So the amount of A-grade collateral (US Treasuries and Bunds) has been significantly reduced. Banks have used financial engineering to solve the problem and “multiply” the amount of collateral, but it doesn’t always work. Less collateral availability reduces banks ability to lend in the offshore funding markets, reducing global USD supply.

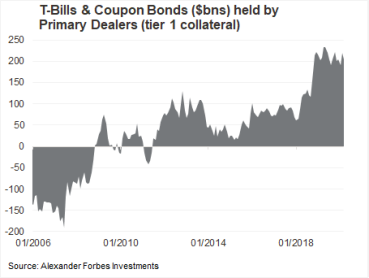

As I show below, banks hoarding tier 1 collateral. Spreads between on-the-run and off-the-run Treasuries are rising sharply as key financial institutions scramble for the most liquidity securities so clearly something remains awry. The repo crisis in Q3 2019 and now the illiquidity induced by the coronavirus shock have revealed underlying troubles in the global financial system!

Ok, so what do we know about eurodollar:

- There is a large offshore funding market for USD outside of US regulation

- The offshore/shadow nature makes is difficult to track; for us, the Fed and regulators

- Shift from liabilities to assets with Basel was an attempt to the challenges

- Regulations constrain banks profitability, but they are always looking for loopholes to extend risk and generate profits, which leads them into the shadows

- Similar to pre-2008, banks continued to expand risk exposure despite the regulations.

- Banks make use repo and collateral to generate offshore funding liquidity

- Tier 1 collateral has become scarce through 2008 and 2012

- Low rates and QE didn’t solve banking issues in 2008, during the Q3 2019 repo market scare and may not solve them in 2020.

There’s a lot there and its very difficult to digest. Believe me, I know! You’re welcome to ask me questions and I’ll do my best to clarify. I’m writing this article to share but also to assist myself in clarifying what I know and what I don’t know. So please pick holes in my understanding as it’ll drive me forward.

Tracking this situation, I keep an eye on:

- The size of off-shore USD denominated debt, which provides an indication of the potential redemptions.

- Primary dealer demand for tier 1 collateral

- Spreads between Eurodollar yields and yields on US regulated securities

- Funding tension within the Eurodollar market

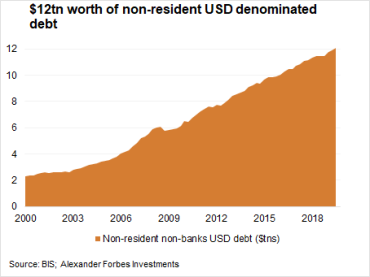

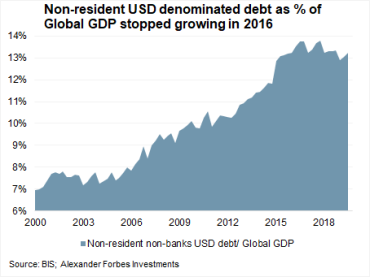

Non-resident USD denominated debt has double since 2008

Non-resident non-bank USD denominated debt doubled from $6tn in 2008 to $12n in Q3 2019 and is more than 13% of global nominal GDP. If one includes the banking sector, central banks and derivates, estimates put total external USD liabilities at 20% of global GDP. The actual number starts to become less relevant at some point. The take-home point is that it is big and its doubled since 2008!

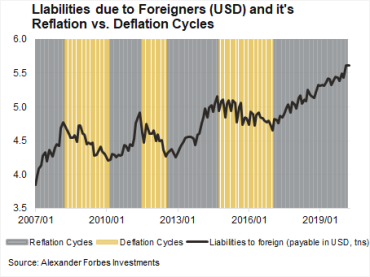

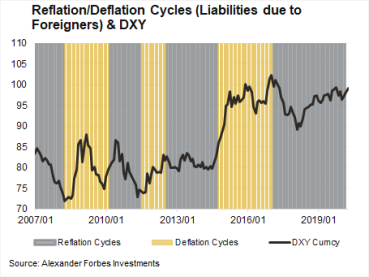

Liabilities payable to foreigners in USD

Liabilities due to foreigners in USD, payable to US banks is another indication of the off-shore market for US dollars - it currently sits at $5.5tn. This has also grown since the GFC but not nearly as much as the figure reported by the BIS, which highlights the amount of USD denominated debt sitting outside of the US banking sector. We notice from the series that there are reasonably clear rising and falling cycles, which I term reflation and deflation cycles because reflation entails an expansion of global USD supply. The dollar index (DXY) clearly performs better in deflation cycles than reflation cycles, which makes sense. The 10-year yield also tends to fall during deflation cycles and rise during reflation cycles. Unfortunately, this data is only released a few months after the fact so it doesn’t provide much predictive power. The data provides a confirmation that USD support could emerge during the next deflation cycle, which could be underway already, but it wasn’t evident in the February 2020 data.

Tier 1 Collateral Demand

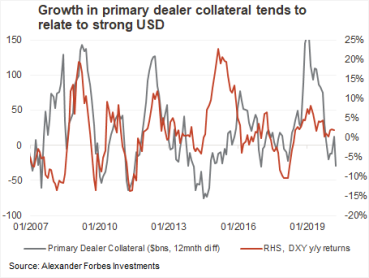

Primary dealers make use of collateral in the repo market to generate Eurodollar liquidity. When there is strong demand for tier 1 collateral (T-Bills and Treasuries) then broader liquidity tends to be tight. We also find a strong relationship to the dollar. Rising demand for collateral tends to be correlated with strong USD performance. In the last three weeks of March primary dealers increased tier 1 collateral holdings.

Increasing demand for tier 1 collateral provides one reason why the Fed’s QE and repo operations are not working. If dealers have a shortage of collateral, buying collateral off their balance sheet could make conditions worse, not better.

Eurodollar rate expectations

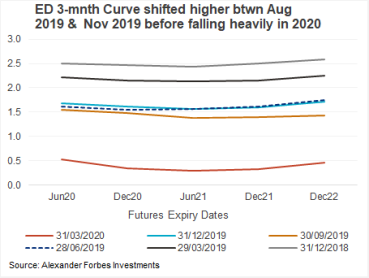

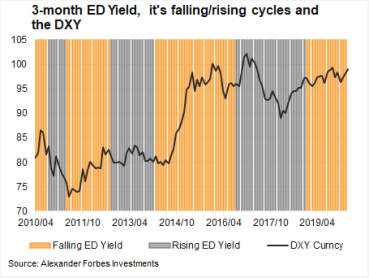

Eurodollar futures price the expectation of the US Fed Funds Rate into the future. They tend to be quite a good indication of risk appetite because the market pushes the Fed towards rate cuts when liquidity is tight. We find that moves lower/higher in 3-month eurodollar (ED) are related to periods of less/better risk appetite. DXY tends to strengthen when ED yields fall and weaken when ED yields rise.

Eurodollar Funding Pressures

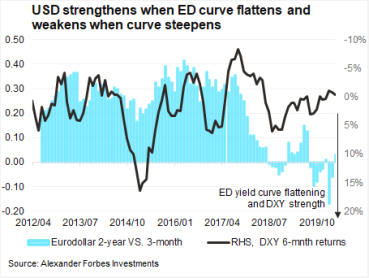

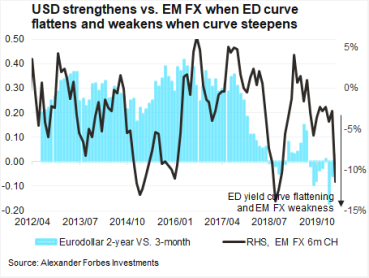

When short-dated rates aren’t falling as much as the longer-dated rates this suggests a tightness in front end liquidity and demand for USD funding. The Flatter ED curve is related to a stronger USD (below, left). DXY gains 1.6% on average in the 6 months following steepening and 0.8% on average in the 6 months following flattening. EM FX risks are particularly acute during these periods (below, right), which is what we’ve already experienced in March 2020.

Tight Interbank Liquidity

The spread between Libor and US Overnight Index Swaps (OIS) is a measure of interbank liquidity stress. It’s remained elevated despite the Fed’s measures to inject significant liquidity into financial markets in March 2020.

Conclusions

A decline in foreign USD liabilities is possible during the current liquidity squeeze, primary dealers are increasing tier 1 collateral, eurodollar futures continue to point towards lower US rates, and the Eurodollar yield curve is flattening again. All these factors are potentially USD supportive. The Fed and Treasuries decisions to lower rates, restart QE and expand the deficit massively should be incredibly negative for the USD. However, the market appears to be rejecting these policies, which can be seen in the inactivity at repo auctions and elevated interbank stress. If these USD funding pressure remain intact and the market continues to reject the injections, we could find ourselves in a period of sharp USD strength. USD strength is the last thing that authorities want, and they’ll probably try and do everything in their power to prevent it. However, I still think we must be aware of these risks because the shift in global banking towards the Eurodollar funding market implies that the Fed has less control over monetary policy. Tightness in funding markets in spite of all the stimulus is clear evidence thereof.

Bottom-line: I’m bearish USD long-term but am concerned with USD strengthening risks, which could remain intact until these funding dislocations fully dissipate. US cash and short-dated US bonds could still be valuable under these conditions.