There are a lot of conflicting signals in the markets at the start of February 2022. The central banking monetary experiment is a long-term catalyst for bitcoin, but the Fed is reversing the trajectory temporarily this year. Macro conditions are responding (before the Fed has done much) which reveals both systemic fragility and a seasonal change in markets. Volatility and reduced risk appetite will burn some retail fingers but institutions will use the lower prices as entry points because bitcoin’s value proposition is as strong as ever. All-in-all, its difficult to see new all-time-highs under these conditions and high-beta assets are less favoured, but sharp rallies and short squeezes are possible in the face of trad-fi macro headwinds.

Summary

- The Fed is tightening and macro conditions are deteriorating

- 2022 will likely remain a tough year as a result and high-beta assets are less favoured

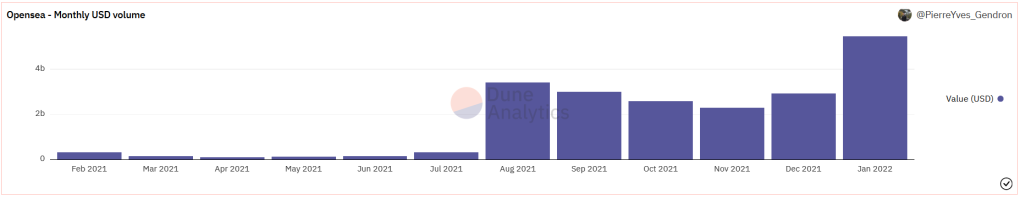

- Watch out for NFTs, which have held up very well in the face of Dec/Jan volatility

- There is strong demand for BTC at lower levels and tight on-chain liquidity shows resilience

- Bitcoin price can experience sharp rallies as shorts get squeezed by tight supply liquidity

- Violent trading activity within wide ranges expected

- Underlying demand will continue despite 2022 volatility

- Watch out for rogue states, large institutions and disillusioned boomers

Fed talks the market into noticeable tightening

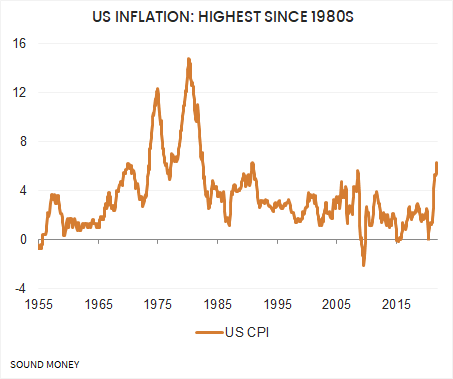

They say actions speak louder than words, but the Fed has managed to change macro conditions merely through talk. US CPI inflation has hit its highest levels since 1982, the Fed is behind the curve and tightening has begun (verbally at least). Why is the Fed speaking about inflation now when it is already so far behind the curve?

The exact motives are unclear but here are three potential reasons:

- The Fed was genuinely surprised by inflation, which is thought would be transitory

- The Fed may want to restore credibility to its mandate and the central banking profession

- The Fed could be under political pressure from the President to tackle rising inflation ahead of US mid-term elections

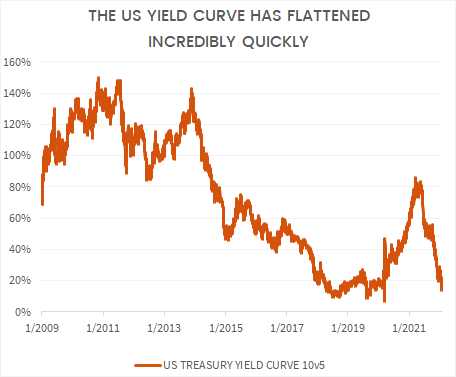

Either way, risk appetite is under pressure because financial markets are addicted to the cheap money drug. The degree to which markets are addicted is revealed in numerous ways, but the yield curve has caught my eye lately.

The 10v5 yield curve (10-year yield less 5-year yield) has fallen from a cycle high of 86bps in March 2021 to 15bps in January 2022 (10 months). By contrast, the last time the curve was at 86bps was July 2014 and it took until April 2017 for the curve to reach 15bps. In those 33 months the Fed raised the Fed Funds Rate 3 times, but it has not increased interest rates once in this cycle yet.

Simplistically, one could conclude that the macro cycle has effectively deteriorated 3 times as fast this time around, merely at the threat of less liquidity being injected. This displays just how addicted financial markets have become to Fed stimulus, which is not a good thing!

Crypto is the far end of the risk spectrum

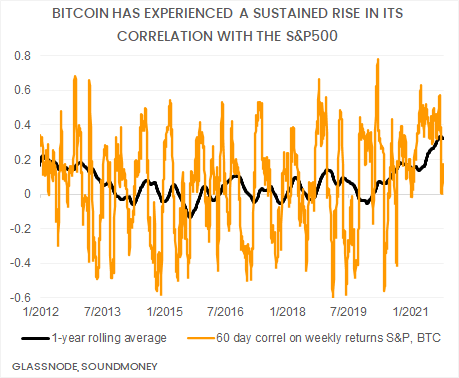

Tightening financial market conditions have found expression in global markets quicker than I thought they would. Risk assets came under pressure and equities tumbled in January 2022. For traditional investors, crypto is the far end of that risk spectrum. The correlation between trad-fi and bitcoin picked up in 2021 so it is no surprise to see bitcoin under pressure. For those who are concerned about the increasing correlation, I encourage you to read this article.

Bitcoin fell 18% in January after falling 19% in December and has now fallen 45% since its peak (52% peak to trough).

After initially holding up well vs. bitcoin, Ethereum came under extreme pressure in January, supporting our thesis that it remains high-beta bitcoin. Ethereum fell 31% in January after falling 17% in December and has now fallen 47% since its peak (55% peak to trough).

The total crypto market cap has fallen from $2.8tn to $1.6tn. Many of the market’s favourite alt coins have come under pressure in January. SOL is down another 20% vs. ETH in December, LUNA is down 18% vs. ETH and UNI is down 6% vs. ETH. (I compare these coins vs. ETH because I see them as further out of the risk spectrum than ETH and consider the differentiation provided vs. ETH’s high-beta qualities)

Macro conditions continue to tighten, for now.

The Fed may only be talking about tightening, but macro conditions continued to tighten in financial markets, with or without Fed action.

- The EURUSD has fallen 2% in January to its lowest levels since June 2020.

- The yield curve has continued to flatten.

- Real rates, although deeply negative, have started to increase.

- The Fed’s balance sheet is not expanding at the same pace that it was

Looking further ahead, sustained monetary tightening is very unlikely.

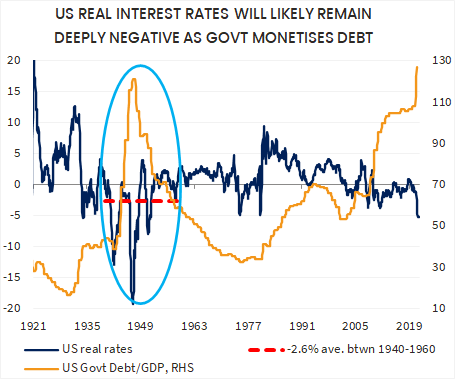

- Debt saturated economies cannot stomach high real interest rates. Real interest rates averaged -2.6% through the 1940s and 1950s.

- The Fed cannot contemplate a deflationary impact of a 50% haircut to listed equities.

But S&P500 only fell 12% peak to trough in January and it has already rebounded into the end of the the month, so the Fed capitulation threshold has not been reached yet.

Macro conditions will remain a headwind in the months ahead until the Fed capitulates. Bright spots and strong periods of performance will almost certainly take place, but it is difficult to believe that widespread new demand will emerge. New All Time High (ATH) prices won’t be easily achieved easily under these conditions.

Continue to expect riskier assets to come under pressure vs. defensive assets under these conditions. This theme is obvious is trad-fi with staples gaining vs. cyclicals and large caps gaining vs. small caps. Within crypto, expect ETH to remain under pressure vs. BTC until macro risks clear. This does not rule out the possibility of short-term counter trend rallies, of course.

Short-term rally underway with on-chain support

In the short-term, there are certainly characteristics that can support risk appetite and lead to strong performance of bitcoin, potentially taking back into the high $40k’s.

- Large participants (either financial institutions or bitcoin whales), did not sell down their holdings substantially through Nov and Dec and have started to purchase below $40K.

- On-chain liquidity is tight, suggesting sell-side liquidity could be less abundant.

- While risk appetite has deteriorated, conditions do not trend in a straight line. An equity market rebound is certainly possible, which would likely be good news for bitcoin.

I said in the 2021 outlook, “with more institutions and less retail we failed to experience a blow-off-top moment and a subsequent price unraveling that would have burnt new entrants and warded off interest for 12 to 18 months. This has reduced the likelihood of a protracted bear market where crypto completely falls off the radar. There is just too much interest at these low prices, too many institutions building in the space and too many others who have not even got their toes wet yet.”

I stand by this view and the sudden interest from larger participants in bitcoin suggests that, below the surface, larger pools of capital are being convinced by the value proposition of decentralised digital scarcity.

Do not give your assets to institutions

Given that there are a number of conflicting signals in the market, I expect pretty choppy market conditions over the coming quarters. Large rallies will take place, but macro conditions remain challenging so its unwise to get ahead of oneself while the macro season is wintry.

A short-term short-squeeze higher is underway, but the $40K region will bring a fair amount of liquidity. A retest of the $30K region is certainly possible again in the coming months if macro liquidity tightens, which will test the fortitude of long-term holders. Hopefully these long-term holders are invested in quality assets and hold on for dear life - do not give your assets to institutions!

While crypto experienced substantial pain in January 2022, there is still a lot of froth in the system. Most notably in NFTs, which have been unfazed by the volatility in trad-fi, BTC and ETH. I expect more of this froth to come out of the market over the coming quarters.

If you would like read more about potential pools of capital that could emerge to push the bitcoin price higher over the coming quarters in spite of challenging macro economic conditions, take a look at:

- This month’s think-piece “Rogue State Adoption”

- Northman Trader’s bitcoin change of heart, which shares great insights into an older social segment that could warm to bitcoin

- India has also just announced an effective legalisation of crypto, opening up 1.4bn people to the asset class.

Conclusions: Institutional demand at lower prices in choppy conditions

- The Fed is tightening and macro conditions are deteriorating

- 2022 will likely remain a tough year as a result and high-beta assets are less favoured

- But there is strong demand at low levels and tight on-chain liquidity shows resilience

- Bitcoin price can experience sharp rallies as shorts get squeezed by tight supply liquidity

- Violent trading activity within wide ranges expected

- Underlying demand will continue despite 2022 volatility

- Watch out for rogue states, large institutions and disillusioned boomers

Great work Rob – all the best on your new endeavour

LikeLike