Headline crypto markets were flat over the past month, which took me somewhat by surprise so in this months market comment I conduct a brief reflection. TLDR: Derivative markets, Evergrande fears and some regulatory fears put crypto on the back-burner. While I am reflective, I am unconcerned. Fundamentals are strong, bitcoin is deeply undervalued and risks are reasonably contained.

Last month I concluded:

“cheap valuation, recovering network health, illiquidity in supply and a reduction in profit taking suggests that the slight pairing back in the BTC price from $50K to $47K is unlikely to unravel much further. If it does, strong support would likely emerge well before the $42K mark, which is not far away. The upside price potential is substantially higher given the metrics suggested earlier.”

I never rule out downside volatility and I do not expect to “predict” each short-term market movement, but nevertheless the price action in the past month caught me somewhat by surprise and warrants reflection. 3 key pieces of information worth noting: derivative markets, trad-fi fears and SEC regulatory apprehension.

Derivative market induced correction

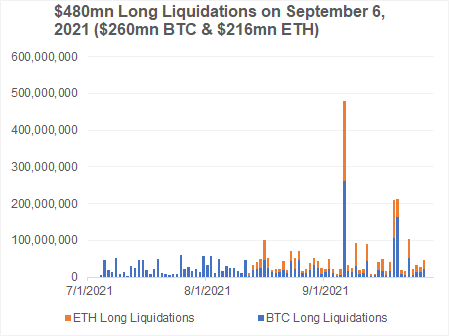

The correction on 6 September was triggered by the derivative markets and accelerated quickly as leveraged traders were liquidated. Between bitcoin and ethereum, nearly half a billion worth of liquidations took place in one day.

Leverage is a market characteristic I pay a fair amount of attention to, so I how did I miss this one?

I underestimated the impact of ethereum back onto bitcoin.

I view ethereum as high-beta bitcoin and assess its performance through bitcoin’s cycle. I stand by this viewpoint. But just like how emerging market volatility can impact global high yield bonds, ethereum can impact bitcoin. Ethereum is even more leveraged than bitcoin and risk in ETH can cascade into BTC. I will pay more attention to this in the future.

Post the liquidations, leverage has settled at some of its lowest levels on record, which is constructive for the future price outlook.

Trad-fi fears filter into crypto

Following the leverage induced sell-off, traditional financial market risk filtered into crypto in the form of Evergrande. While bitcoin is a potential future global reserve asset, it certainly functions as a high risk asset for trad-fi. Traditional investors will cut crypto exposure and flea towards perceived traditional safety during times of market stress. Side note: bitcoin outperformed the S&P on the month

Given that global liquidity remains flush, I do not expect Evergrande to trigger wholesale liquidations in risk. Fed balance sheet growth is still growing at double digits year on year. Going forward, trad-fi risks remain a focal point. Contagion from the Fed’s efforts to tighten, or at least their desire to talk about it, will almost certainly translate into volatility over the coming quarters.

Major on-chain support below $41K

The trad-fi risks pulled bitcoin another leg lower from $48K to $41K but, as expected, strong support has emerged in this region. Major on-chain support remains below the $41K region (i.e. lots of previous buyers at these levels) so there is a good chance that price bounces strongly, once technical traders are confident that the levels has held.

Our fundamental network valuation metrics remain very constructive, valuing bitcoin close to 50% below fundamental value. Importantly, network health has not been impacted by the price decline from $53K to $41K. Bitcoin is trading at some of the most undervalued levels on record. Subsequent bitcoin returns are particularly strong when price declines relative to fundamental value, which is the current condition in which we find ourselves.

Within-crypto risk continues to moderate

In terms of within crypto risk, ETH has paired back vs. BTC over the past month as total crypto price momentum took a breather. Defi fell almost 30%, reflecting a deeper unwind in risk appetite. I expect we could experience a little more sideways price action in the ETHBTC cross over the next month because bitcoin fundamentals are looking incredibly optimistic at this stage and ethereum fundamentals do not quite match up. I am monitoring Defi amongst other indicators for a clearer that ETH outperformance vs. BTC is a higher probability outcome.

I am going to leave it there for this month.

Wishing you a great October!